Youth Brand Affinity Tracker

US Edition

UK Edition

Each quarter, we analyze the performance of leading brands in 10 of the sectors most important to Gen Z consumers.

To compile the Youth Brand Affinity Tracker, we look at four key metrics: Brand visibility, brand engagement, purchase intent & brand advocacy.

Fashion

We polled over 1,000 young people to find out which fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

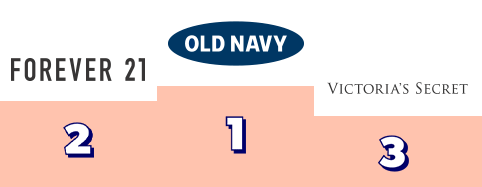

There’s change at the top in the fashion category, as Old Navy resumes first place, after giving up the no.1 spot to Forever 21 last quarter. Old Navy’s Youth Affinity Score increased by 7, while Forever 21’s dropped by the same amount. Old Navy’s win will be great news to its parent company Gap Inc., as its flagship brand Gap is struggling with the younger demographic. While brand recognition remains high, engagement, intent and advocacy are low, especially compared to competitors like American Eagle, which has a similar all-American aesthetic but has managed to remain more relevant.

Victoria’s Secret has been in the news recently, with the announcement that they are rethinking their brand positioning for Gen Z, aiming to better reflect the values of the new generation of shoppers. While this sounds like a great move for the brand, which is now over 40 years old, our research shows they already have a strong foundation to build upon with young female consumers. 96% of them recognize the brand, and an impressive 45% intend to buy from Victoria’s Secret within the next three months. We look forward to seeing how these numbers may grow in the year ahead… could they finally overtake Old Navy or Forever 21?

Elsewhere in the chart, the rise of Chinese challenger brand Shein continues, with brand visibility up by 4% and brand advocacy by 3%. Shein recently overtook Amazon as the most installed fashion app in America. Their app-first strategy, along with strong digital advertising and influencer partnerships, has been a hit with Gen Z, and their American ecommerce competitors will need to adapt quickly to keep up.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Old Navy | 89% | 37% | 34% | 40% | 95 |

| 2 | Forever 21 | 85% | 37% | 33% | 40% | 88 |

| 3 | Victoria’s Secret | 88% | 36% | 31% | 43% | 84 |

| 4 | H&M | 77% | 32% | 31% | 39% | 60 |

| 5 | American Eagle / Aerie | 77% | 30% | 31% | 38% | 55 |

| 6 | Shein | 63% | 34% | 32% | 36% | 53 |

| 7 | Hollister | 77% | 26% | 25% | 34% | 41 |

| 8 | Gap | 80% | 22% | 21% | 26% | 30 |

| 9 | Fashion Nova | 68% | 22% | 22% | 26% | 28 |

| 10 | Urban Outfitters | 67% | 19% | 19% | 27% | 18 |

Fashion – Retail

We polled over 1,000 young people to find out which in-store fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

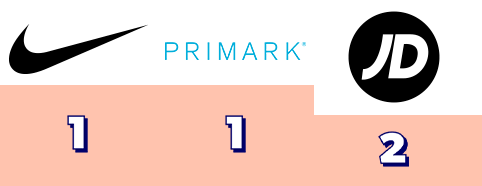

In the fashion sector, we’ve seen two very different brands vying for first place since we launched the Youth Brand Affinity Index last year: Primark and Nike. As one of the few major high street retailers with no ecommerce offering, Primark’s brand engagement dipped in the first few months of 2021, but we can see in our data that they were back on track when stores reopened post-lockdown in Q2, with an impressive increase from 41% to 58%. After previously taking second place in our fashion top 10, they’re now tied with Nike for the top spot.

While they might be sharing first place in our chart, it’s also been a great quarter for Nike. One reason that young people love this brand is their willingness to stand up for their values and sometimes take controversial stances. In the past, they partnered with Colin Kaepernick after he was ousted from the NFL for protesting police brutality, and more recently they stood by Sha’Carri Richardson when she was banned from the Olympics for using marijuana. Nike demonstrates a clear awareness of where young people’s views lie on topics such as legalising marijuana, racism and freedom of protest. The fact that they are willing to sacrifice the custom of other groups, who may not agree with their stance, shows Gen Z that Nike isn’t simply virtue signalling when it proclaims its values.

New to the top 10 this quarter is Footlocker, which performed well on the brand visibility and advocacy metrics, but fell slightly short on engagement and purchase intent. As Footlocker’s Gen Z customer base skews strongly male, according to our research, strategies to engage the increasing number of young women interested in sport and fitness could be key to becoming a stronger competitor in this category.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| =1 | Nike | 96% | 48% | 41% | 55% | 93 |

| =1 | Primark | 95% | 58% | 51% | 51% | 93 |

| 3 | JD Sports | 95% | 45% | 38% | 48% | 78 |

| 4 | Adidas | 97% | 39% | 31% | 44% | 70 |

| 5 | H&M | 92% | 42% | 36% | 43% | 60 |

| 6 | Sports Direct | 95% | 39% | 33% | 40% | 55 |

| 7 | New Look | 88% | 34% | 28% | 37% | 38 |

| 8 | Next | 93% | 30% | 24% | 34% | 33 |

| 9 | Zara | 81% | 27% | 26% | 34% | 18 |

| 10 | Footlocker | 84% | 25% | 24% | 34% | 15 |

Sports & Athleisure

We polled over 1,000 young people to find out which sports and athleisure brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

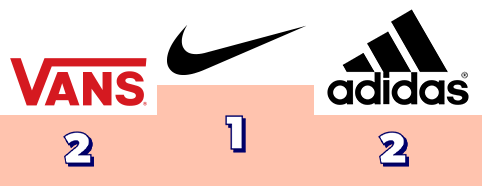

It’s great news for Nike this quarter, as it not only retains its place at the top of our sports and athleisure top 10, but has actually achieved an increase across the three most important metrics we measure: brand engagement, purchase intent and brand advocacy. Purchase intent is particularly high with undergraduate students, 60% of whom intend to buy from Nike in the next three months.

One reason that young people love this brand is their willingness to stand up for their values and sometimes take controversial stances. In the past, they partnered with Colin Kaepernick after he was ousted from the NFL for protesting police brutality, and more recently they stood by athlete Sha’Carri Richardson when she was banned from the Olympics for using marijuana, and said that they would continue supporting her. This demonstrates a clear awareness from the brand of where young people’s views lie on topics such as legalizing marijuana, racism and freedom of protest. The fact that they are willing to sacrifice the custom of other groups, who may not agree with their stance, proves to Gen Z that Nike isn’t simply virtue signalling when it proclaims its values.

Also in the top five this quarter, we see Vans catching up with Adidas for the first time since we launched the Brand Affinity Index last year. This success is driven particularly by female 16- to 24-year olds, 48% of whom have engaged with Vans in the past three months. Vans is associated with a skater culture that has stayed consistently cool for many years, but has had a particular resurgence with the return to popularity of emo music and aesthetics such as e-girls and e-boys, which are popular on TikTok. Vans has a strong presence on the social video platform, with more than 2 million likes and 250k followers.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Nike | 93% | 60% | 56% | 65% | 100 |

| =2 | Adidas | 90% | 43% | 37% | 50% | 85 |

| =2 | Vans | 89% | 42% | 38% | 52% | 85 |

| 4 | Converse | 84% | 32% | 27% | 44% | 65 |

| 5 | Footlocker | 83% | 27% | 27% | 37% | 58 |

| 6 | Under Armour | 82% | 27% | 24% | 36% | 50 |

| 7 | Puma | 86% | 23% | 22% | 31% | 43 |

| 8 | The North Face | 71% | 21% | 23% | 35% | 35 |

| =9 | Fabletics | 43% | 11% | 13% | 17% | 15 |

| =9 | Gymshark | 39% | 12% | 11% | 18% | 15 |

Fashion – Ecommerce

We polled over 1,000 young people to find out which online fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

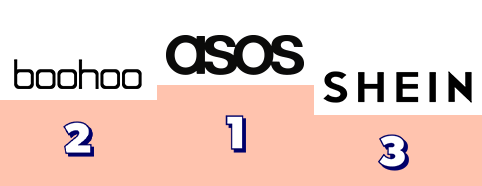

ASOS takes the top spot in the online fashion sector for the fourth quarter in a row, but the brand has seen a drop in engagement, purchase intent and brand advocacy compared to our Q2 survey. This isn’t too surprising since the business reported a decline in sales in their latest earnings update, which led to a fall in share price. CEO Nick Beighton attributed this to the travel restrictions which mean fewer young Brits are going abroad this summer, and therefore the brand isn’t seeing the usual influx of pre-holiday purchases that normally take place at this time of year.

ASOS isn’t alone in experiencing a decline across those key engagement and intent metrics this quarter. They are joined in this by all the brands featured except for I Saw It First, whose results stayed consistent from Q2 to Q3, and In The Style, a new addition to the list this quarter.

There is positive news for Boohoo, however, as the Manchester-based brand reclaims its spot in second place, after losing it to Chinese competitor Shein last quarter.

This was the first time that Shein didn’t achieve a significant improvement on their scores from the previous quarter, suggesting that its extraordinary growth may have plateaued. Shein has upped its marketing efforts in recent weeks with the launch of a collection in partnership with Made in Chelsea star Georgia Toffolo, who features in a new TV advert for the online retailer, so it’ll be interesting to see how this impacts their performance in our next survey.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | ASOS | 89% | 45% | 41% | 47% | 100 |

| 2 | Boohoo / Boohoo Man | 85% | 35% | 32% | 39% | 85 |

| 3 | Shein | 73% | 42% | 36% | 38% | 78 |

| 4 | Pretty Little Thing | 81% | 33% | 27% | 35% | 73 |

| 5 | Depop | 76% | 31% | 24% | 35% | 60 |

| 6 | Gymshark | 78% | 22% | 23% | 32% | 53 |

| 7 | Missguided | 68% | 22% | 18% | 26% | 43 |

| 8 | I Saw It First | 50% | 18% | 16% | 19% | 28 |

| 9 | Nasty Gal | 53% | 15% | 12% | 19% | 23 |

| 10 | In The Style | 38% | 12% | 12% | 15% | 10 |

Retail

We polled over 1,000 young people to find out which retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Amazon is a winner once again in the retail category, which encompasses all those stores that “sell everything,” from department stores and big box retailers to ecommerce marketplaces. Q2 was a big quarter for Amazon as it ended with the focal point of Prime Day, which was extended to two days: June 21-22.

According to Adobe, the event was predicted to generate sales of $5.6 billion within its first 24 hours alone, an 8.7% increase from the previous year. With deals available exclusively to members of Amazon Prime, the event is a major driver of new subscriptions. For the Gen Z market in particular, the Prime Student offering is a big hit, with over 200 million members worldwide as of April this year.

Aside from Amazon, one brand that stands out in this category is TJ Maxx, which has achieved an impressive rise from ninth to fifth place in our chart this quarter. Known for selling designer brands at an affordable price, TJ Maxx’s popularity with young consumers reflects their desire to own designer labels and high-end products, which conflicts with their often limited budgets.

Stores like TJ Maxx enable young shoppers to own their first items from luxury brands such as Gucci, Givenchy, and Céline. Finding a bargain gives them a buzz that generates loyalty and brand advocacy.

Although TJ Maxx ranked fifth in our chart overall, those who have engaged with the brand are the third most likely to recommend them, below only Amazon and IKEA. TJ Maxx has the lowest brand visibility of all those in our list, but this has increased by 5% in the past three months, showing strong signs of a successful year ahead.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 92% | 68% | 65% | 66% | 100 |

| 2 | Home Depot | 90% | 35% | 30% | 38% | 85 |

| =3 | Bed Bath & Beyond | 85% | 30% | 28% | 40% | 65 |

| =3 | eBay | 88% | 32% | 29% | 34% | 65 |

| 5 | TJ Maxx | 81% | 32% | 28% | 38% | 58 |

| 6 | Macy’s | 88% | 28% | 23% | 34% | 44 |

| 7 | JC Penney | 89% | 27% | 24% | 33% | 43 |

| 8 | Kohls | 84% | 28% | 23% | 36% | 40 |

| 9 | Lowe’s | 84% | 28% | 23% | 32% | 26 |

| 10 | IKEA | 83% | 24% | 21% | 37% | 25 |

Retail

We polled over 1,000 young people to find out which of the retail superstores resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Amazon is a winner once again in the retail category, which encompasses all those stores that “sell everything,” from department stores and big box retailers to ecommerce marketplaces. Q2 was a big quarter for Amazon as it ended with the focal point of Prime Day, which was extended to two days: June 21-22.

According to Adobe, the event was predicted to generate sales of $5.6 billion within its first 24 hours alone, an 8.7% increase from the previous year. With deals available exclusively to members of Amazon Prime, the event is a major driver of new subscriptions. For the Gen Z market in particular, the Prime Student offering is a big hit, with over 200 million members worldwide as of April this year.

This quarter we see IKEA and John Lewis drop down the retail chart. This could have been impacted by John Lewis store closures, but it also suggests that big purchases are not on the cards for Gen Z at the moment. They are likely to see better results in the coming months however, as students shop for their return to campus – or for many the first time living away from home.

According to a survey we conducted in March, 67% of Student Beans users who will be starting university this year plan to move out of their family home, with the majority of those moving to a new city. We also know that IKEA is the brand that more of our existing university student users spent money on during Freshers season than any other, ahead of Wilko, Primark, Tesco and more.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 98% | 74% | 69% | 66% | 100 |

| 2 | eBay | 96% | 49% | 41% | 47% | 90 |

| 3 | Argos | 96% | 40% | 35% | 46% | 78 |

| 4 | B&M | 87% | 40% | 37% | 43% | 60 |

| 5 | IKEA | 94% | 33% | 31% | 46% | 60 |

| 6 | M&S | 95% | 33% | 28% | 36% | 53 |

| 7 | Wilko | 84% | 34% | 28% | 35% | 38 |

| 8 | WHSmith | 91% | 27% | 22% | 36% | 33 |

| 9 | Etsy | 76% | 29% | 25% | 34% | 23 |

| 10 | John Lewis | 91% | 21% | 19% | 32% | 18 |

Grocery

We polled over 1,000 young people to find out which grocery brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Walmart takes the no.1 spot again this quarter in our grocery top 10. The nationwide super-brand has a loyal customer base compared to competitors, as 86% of those who have engaged with the brand are intending to purchase from them in the next three months, compared to 79% for its closest rival, Target.

Walmart has made some smart moves in recent months that will help them retain Gen Z’s loyalty. Firstly, the business has committed to paying 100% of college tuition and books for its associates, which not only helps young people who may struggle balancing work and school, but also appeals to Gen Z’s values. Free education is one of the issues they feel most strongly about.

In a recent Student Beans survey, we learned that 92% of college students want to see student loan forgiveness rolled out by Joe Biden’s administration. Another interesting move from Walmart is the choice of their first DTC skincare partner, a brand named Bubble which is squarely aimed at the youth demographic. Bubble products will now be stocked in Walmart stores across America.

If any grocery stores brands were wondering whether it was worthwhile targeting their marketing and advertising efforts to Gen Z, we can confidently say that it is. Although many 16-24s live at their family home, they are still shopping for groceries, and they’re happy to do so from the major chain stores. 95% of our survey respondents had engaged with at least one of the 10 big brands we listed within the past three months. As for the months ahead, 96% of undergraduate students plan to make a purchase, and high school students are only slightly less likely, at 91%. This shows the importance of building relationships with these customers at an early age.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Walmart | 96% | 71% | 67% | 62% | 100 |

| 2 | Target | 94% | 60% | 55% | 61% | 90 |

| 3 | 7-Eleven | 89% | 39% | 33% | 34% | 78 |

| 4 | CostCo | 77% | 31% | 28% | 37% | 73 |

| 5 | Whole Foods Market | 69% | 23% | 21% | 30% | 55 |

| 6 | Kroger | 66% | 25% | 24% | 26% | 45 |

| 7 | Aldi | 64% | 26% | 24% | 28% | 43 |

| 8 | Trader Joe’s | 65% | 22% | 19% | 27% | 38 |

| 9 | Safeway | 46% | 18% | 16% | 18% | 18 |

| 10 | Publix | 45% | 19% | 15% | 20% | 13 |

Supermarkets

We polled over 1,000 young people to find out which supermarket brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in..

Key Takeaways:

While the top five supermarkets have stayed consistent between Q2 and Q3, we see more movement lower down the chart, where Co-op and Waitrose have both moved up one spot. Both brands are among the supermarkets with higher price points, which shows that there is a market for higher end grocery products among Gen Z. These brands’ ethical track record is also a stronge incentive for young shoppers to spend money with them. Student-specific deals, such as Co-op’s always-on student discount, will be key to attracting more young shoppers, especially as new students do their own grocery shopping for the first time during the upcoming Freshers season.

Our research shows that 16-24s like to shop from several different supermarkets, happy to visit different chains to pick up their favourite exclusive items and shop around for the best price on those standard products that every store sells. Only 9% of our survey respondents said they had engaged with only one of these retailers, and the average student had engaged with 4.3 of them. This approach to grocery shopping gives the brands the opportunity to win over this audience, as they’re open to trying new things and their loyalty is clearly still up for grabs at this age.

The UK supermarket industry entered Q3 amid concerning food shortages, caused by a labour shortage due to the rise in COVID cases across the country that has resulted in an increase in workers needing to self-isolate. This has affected the food industry at every level, from delivery drivers to in-store workers, and supermarkets have been forced to get creative to hide the empty shelves in the hopes of avoiding panic buying. We’ll be interested to see how this unfolding story impacts the results of our next quarterly brand affinity survey.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Tesco | 97% | 65% | 64% | 62% | 100 |

| 2 | ASDA | 96% | 59% | 52% | 51% | 88 |

| 3 | Sainsbury’s | 97% | 50% | 44% | 46% | 75 |

| 4 | Aldi | 94% | 52% | 43% | 48% | 73 |

| 5 | Lidl | 95% | 44% | 39% | 47% | 63 |

| 6 | Co-op | 94% | 46% | 36% | 37% | 50 |

| 7 | Morrison’s | 93% | 40% | 36% | 39% | 43 |

| 8 | Iceland | 93% | 37% | 33% | 36% | 30 |

| 9 | Waitrose | 86% | 16% | 20% | 25% | 18 |

| 10 | Spar | 72% | 19% | 19% | 20% | 13 |

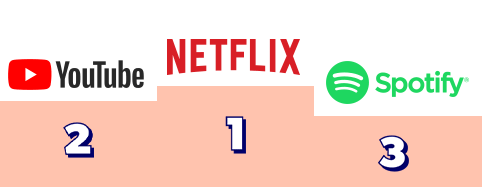

Entertainment

We polled over 1,000 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Topping the entertainment sector chart is YouTube, which has recently been celebrating a record-breaking quarter for ad revenue. YouTube ads brought in $7 billion in Q2, an 84% increase year-on-year. This success reflects a bounceback in ad spend following the COVID-19 dip, but there’s also excitement around the platform’s new YouTube Shorts product, its response to the phenomenon that is TikTok. There’s been some skepticism towards this pursuit of Gen Z relevancy, but results are positive so far. Google CEO Sundar Pichai announced that Shorts generated 15 billion daily views in Q2, up from 6.5 billion in the previous quarter.

Within this sector, there are some clear differences between how male and female Gen Zs perceive and engage with different types of entertainment. Visibility across all brands in this list is evenly spread between genders, but when it comes to engagement, this is higher for females than males across the streaming brands, and higher for males for the gaming brands. There’s one exception, however – 90% of females have engaged with Nintendo in the past three months compared to 88% of males. This shows that Nintendo has recognized the potential of the female gaming market, and successfully won over this demographic, thanks to franchises such as Animal Crossing and Pokémon.

As the summer months arrive, COVID restrictions are relaxed and young people spend more time on out-of-home activities, entertainment brands could have expected a decline in purchase intent among the 16-24 audience, so they’ll be reassured to hear this is not the case. Overall, we found that 88% of students expect to make a purchase with at least one of the entertainment brand in our list within the next three months, the same percentage as three months earlier.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | YouTube | 95% | 77% | 44% | 68% | 96 |

| 2 | Netflix | 95% | 72% | 54% | 66% | 94 |

| 3 | Spotify | 92% | 56% | 38% | 56% | 73 |

| 4 | Disney+ | 91% | 55% | 42% | 54% | 68 |

| 5 | Hulu | 92% | 55% | 40% | 53% | 63 |

| 6 | Playstation | 93% | 40% | 31% | 44% | 58 |

| 7 | Nintendo | 89% | 37% | 30% | 42% | 35 |

| 8 | Xbox | 90% | 36% | 28% | 41% | 30 |

| 9 | Apple Music | 89% | 34% | 29% | 38% | 20 |

| 10 | GameStop | 90% | 31% | 27% | 36% | 15 |

Entertainment

We polled over 1,000 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

While Netflix stays in first place this quarter in the entertainment sector, the streaming superpower may be concerned to hear that their fast-growing rival Disney+ ascended the charts, moving from fifth to fourth place. Initially launching with a selection of content that primarily focused on action movies and family-friendly Disney classics, they’ve been able to win over new customers by broadening their range this year. The addition of Star, a content hub within Disney+ featuring shows from US TV networks Freeform, FX, ABC and more, brings a wider variety of comedy, drama and other entertainment genres to the platform.

Disney+ is most popular with undergraduate students, with whom their engagement rate is 55% – notably higher than the average. Nintendo and Spotify also performed best with the undergraudate crowd, while YouTube is particularly strong with those at sixth form or college. This suggests that as students gain greater independence and disposable income, they’re more likely to invest money in subscription services, while younger students are more reliant on the ad-supported model. The humour and influencer-led content of YouTube also has greater appeal to the younger members of Gen Z.

Brands across the entertainment sector will be pleased to hear that brand advocacy increased across the board this quarter. Entertainment brands have played a vital role over the past year, bringing joy and distraction when they were much needed, so this has created a powerful bond with customers that inspires them to recommend and advocate for these brands. By recommending a streaming service or games console to a friend, they get to turn something that’s typically private and personal into a more social experience.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Netflix | 97% | 76% | 59% | 71% | 98 |

| 2 | YouTube | 97% | 77% | 40% | 65% | 90 |

| 3 | Spotify | 96% | 65% | 46% | 59% | 83 |

| 4 | Disney+ | 94% | 49% | 37% | 48% | 65 |

| 5 | Playstation | 96% | 39% | 31% | 45% | 61 |

| 6 | Xbox | 96% | 37% | 27% | 37% | 54 |

| 7 | Nintendo | 94% | 29% | 22% | 37% | 40 |

| 8 | Apple Music | 92% | 28% | 21% | 29% | 28 |

| =9 | Game | 83% | 24% | 20% | 31% | 20 |

| =9 | Now TV | 87% | 23% | 17% | 27% | 13 |

Travel

We polled over 1,000 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Last quarter we saw an exciting increase in brand engagement and purchase intent across the travel sector, showing that young people were ready to travel again after a COVID-enforced break. While these numbers didn’t increase again this quarter, they did stay consistent, which is still very good news for the travel industry as it strives to make up lost revenue. In a 2020 survey of Student Beans users we learned that summer is the most common time for US students to book and pay for a vacation, so now is the time to invest in marketing to this demographic.

One sub-sector of travel that has seen growth this quarter is the sharing economy. Uber, Lyft and Airbnb are up on Q2 across each of the metrics we’re tracking. This reflects an increased comfortability with these types of services as more young people get vaccinated and become open to activities that would have been considered too risky, even just a few months ago.

Brands such as Uber, Lyft and Airbnb have pursued aggressive discounting tactics to encourage customers to return to old habits.

Another brand that had a good quarter was TripAdvisor, which grew 4% in brand visibility and 2% in brand advocacy. In addition to its ecommerce business, TripAdvisor also aggregates customer reviews and ranks attractions, restaurants, hotels and more based on the feedback of its community. In a survey for our 2020 Student Shopping Report, we learned that comparison sites are the most popular way for students to look for travel deals, while travel sites and blogs are the second most likely place they’ll get travel inspiration – only behind social media.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 89% | 40% | 37% | 47% | 100 |

| 2 | Lyft | 78% | 26% | 24% | 34% | 85 |

| 3 | Airbnb | 74% | 26% | 23% | 37% | 83 |

| 4 | American Airlines | 77% | 20% | 16% | 25% | 68 |

| 5 | Delta | 71% | 18% | 17% | 24% | 58 |

| 6 | United Airlines | 73% | 19% | 17% | 21% | 50 |

| =7 | Southwest Airlines | 64% | 16% | 14% | 22% | 35 |

| =7 | TripAdvisor | 66% | 16% | 13% | 23% | 35 |

| 9 | Booking.com | 54% | 15% | 16% | 21% | 25 |

| 10 | Expedia | 57% | 13% | 13% | 18% | 13 |

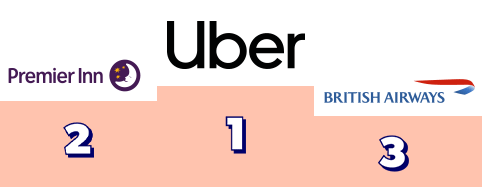

Travel

We polled over 1,000 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

In our Q2 report we shared exciting news for the travel sector, as the brands featured in our chart saw a surge in engagement, purchase intent and brand advocacy. This quarter unfortunately we haven’t seen scores continue to rise, although they have mostly stayed consistent. This is likely to be caused by the travel restrictions which are limiting travel abroad by making it complicated and expensive, due to the need for several PCR tests. While these restrictions are now starting to relax for those who are double vaccinated, this doesn’t apply to the majority of young people, so the summer break has not been the bounceback that businesses focused on international travel would have hoped for.

One brand that has seen growth this quarter is Uber. This reflects an increased comfortability with services like this, which are part of the sharing economy, as more young people get vaccinated and become open to activities that would have been considered too risky, even just a few months ago. Uber has pursued aggressive discounting tactics to encourage customers to return to old habits. They also invested in drivers, offering more generous pay to encourage more of them back onto the roads, especially in order to meet rising demand as out-of-home socialising is back on the agenda.

Looking ahead to the rest of 2021, if travel restrictions continue to be loosened and vaccination rates for young people are high, we could see more people taking late summer trips outside the UK. Meanwhile, domestic travel brands like Travelodge and Premier Inn should be taking advantage of a market desperate for a break, and looking for fun and affordable UK-based alternatives to their usual holiday abroad.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 93% | 36% | 40% | 42% | 100 |

| 2 | Premier Inn | 88% | 30% | 26% | 39% | 85 |

| 3 | British Airways | 90% | 23% | 22% | 35% | 78 |

| 4 | Booking.com | 76% | 27% | 26% | 32% | 65 |

| 5 | Airbnb | 80% | 23% | 22% | 31% | 55 |

| 6 | EasyJet | 89% | 21% | 19% | 30% | 53 |

| 7 | National Express | 75% | 20% | 20% | 27% | 38 |

| 8 | RyanAir | 82% | 20% | 19% | 23% | 35 |

| 9 | Travelodge | 84% | 20% | 18% | 27% | 33 |

| 10 | TUI | 69% | 15% | 14% | 22% | 10 |

Health & Beauty

We polled over 1,000 young people to find out which health and beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

It’s great news for Walgreens as the retailer has not only retained its place at the top of our health and beauty chart, but improved its performance across all four of the metrics we track: brand visibility, engagement, purchase intent, and advocacy.

Walgreens recently brought on a new CEO, Rosalind Brewer, who has stated her commitment to developing tech innovation within the company. As investor capital pours into the new crowd of health tech startups, established businesses like Walgreens will need to move quickly to stay ahead. The hype around these startups shows the immense potential in this sector, and Walgreens has an edge over the newcomers as it has the trust and loyalty of the next generation of consumers, as our research demonstrates. Of those who have engaged with Walgreens in the past three months, 72% would recommend the brand to a friend, higher than the equivalent stat for the other pharmacies in our list (70% for CVS and 57% for Rite Aid).

Another brand that had a good quarter is e.l.f Cosmetics, which moved up a place to tie with L’Oreal, thanks to an impressive 7% increase in brand advocacy compared to our Q2 survey. e.l.f was one of the first brands to fully invest in TikTok as a marketing platform, and their bet on the social media newcomer definitely paid off. According to the agency behind their #eyeslipsface challenge, it generated over 5 million user-generated videos and 7 billion views. It was described by AdWeek as “the most influential campaign on TikTok,” setting the precedent for what could be achieved on the platform at a time when many marketers were still unsure of how brands could fit into this very personality-driven space.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Walgreens | 88% | 49% | 42% | 46% | 96 |

| 2 | Bath & Body Works | 86% | 44% | 42% | 53% | 93 |

| 3 | CVS | 86% | 44% | 39% | 42% | 81 |

| 4 | Ulta Beauty | 69% | 28% | 30% | 37% | 65 |

| 5 | Sephora | 72% | 26% | 24% | 36% | 63 |

| =6 | e.l.f Cosmetics | 53% | 21% | 19% | 28% | 45 |

| =6 | L’Oreal | 71% | 20% | 19% | 28% | 45 |

| 8 | MAC | 58% | 15% | 15% | 23% | 28 |

| 9 | Rite Aid | 52% | 18% | 17% | 21% | 25 |

| 10 | Glossier | 38% | 13% | 12% | 19% | 10 |

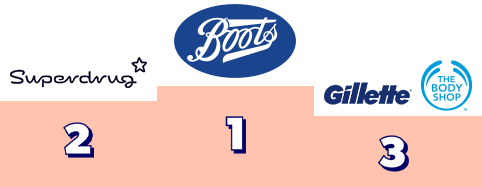

Health & Beauty

We polled over 1,000 young people to find out which health and beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

The UK’s biggest high street pharmacies Boots and Superdrug have retained their positions as the top of our health and beauty sector chart this quarter. Boots CEO Seb James recently announced that make-up would be the retailer’s priority in the months ahead, as they anticipate demand to soar as consumers return to in-person work and social events. They will introduce several new brands to their stores, including Drunk Elephant, Kylie Skin and Rihanna’s Fenty Beauty, all popular with Gen Z.

There’s good news for Gillette this quarter, as the popular shaving brand catches up with The Body Shop to place joint-third in our health and beauty chart. As a brand that’s been around for over 100 years, it’s essential for Gillette to adapt to changing retail trends, especially if they want to remain relevant to the younger generation of consumers. One way they’re attempting this is through a new partnership with Hypebeast, with whom they have co-created Hypebeast’s first male grooming product. The limited edition razor will be available in Boots and from Hypebeast’s online store. Gillette has also brought on young football star Raheem Stirling as a brand ambassador.

Also moving up in the chart are Holland & Barrett and Pure Gym, both overtaking online retailer Beauty Bay. While Holland & Barrett, which has 715 stores around the UK, has undoubtedly benefited from the reopening of physical retail in Q2, Pure Gym is winning back customers who are finally feeling safe to return to the gym as COVID restrictions are released. A survey we conducted earlier this year found that 19% of Student Beans users who hadn’t previously gone to the gym were keen to start this after the pandemic, so now is a great time for brands in the fitness space to be targeting this audience.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Boots | 94% | 53% | 49% | 52% | 100 |

| 2 | Superdrug | 92% | 48% | 44% | 50% | 90 |

| =3 | Gillette | 83% | 28% | 26% | 32% | 73 |

| =3 | The Body Shop | 82% | 28% | 24% | 36% | 73 |

| 5 | Lush | 74% | 25% | 22% | 37% | 63 |

| 6 | Holland & Barrett | 74% | 25% | 21% | 30% | 50 |

| 7 | Pure Gym | 71% | 21% | 21% | 28% | 43 |

| 8 | Beauty Bay | 48% | 21% | 19% | 26% | 23 |

| 9 | MAC | 67% | 16% | 16% | 26% | 20 |

| 10 | MyProtein | 48% | 18% | 18% | 23% | 18 |

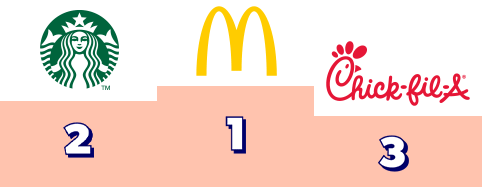

Restaurants & Takeout

We polled over 1,000 young people to find out which restaurants and takeout brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Most of our top restaurant and takeout brands stayed strong in their positions this quarter, with the exception of Wendy’s, which has slipped one place, making room for Taco Bell to enter the top five. McDonald’s retained its place at the top, undoubtedly helped by their recent collaboration with Gen Z’s favorite boyband, BTS. The company recently announced that the partnership had contributed to an incredible 40% sales spike globally, and fans were photographed queuing on launch day to be first to get the BTS meal. The next artist to collaborate on a McDonald’s meal is American rap star Saweetie, and we can surely expect more big names to follow after the latest success.

Overall in the restaurant and takeout sector, we saw an uplift in brand engagement and purchase intent compared to the previous quarter. One business in our list that is likely to have a particularly profitable quarter ahead with the Gen Z market is Starbucks. The coffee company has increased its purchase intent by 6% compared to three months ago. This could be attributed to viral trends on TikTok, where creators are suggesting quirky Starbucks orders for their followers to try. The most popular, now known as “the TikTok drink,” is a Venti-sized Strawberry Açaí Refresher with three scoops of strawberries, three scoops of blackberries, and a “matching size scoop of ice” all blended together.

Only 6% of our panel of 16-24s said they would not spend at any of the restaurants listed this quarter, compared to 9% in our last survey. This shows that the return to dining out is in full swing post-COVID, and meeting at restaurants or grabbing takeout for a night in with friends is definitely key to Gen Z’s summer plans.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 95% | 66% | 59% | 52% | 95 |

| 2 | Starbucks | 93% | 50% | 50% | 55% | 88 |

| 3 | Chick-Fil-A | 92% | 48% | 46% | 53% | 65 |

| 4 | Subway | 93% | 46% | 43% | 48% | 64 |

| 5 | Taco Bell | 93% | 49% | 41% | 45% | 63 |

| 6 | Wendy’s | 93% | 45% | 42% | 45% | 50 |

| 7 | Burger King | 93% | 41% | 36% | 38% | 43 |

| 8 | Dunkin’ Donuts | 93% | 38% | 37% | 46% | 40 |

| 9 | Pizza Hut | 93% | 36% | 31% | 41% | 31 |

| 10 | Chipotle | 88% | 32% | 31% | 39% | 13 |

Restaurants & Takeaway

We polled over 1,000 young people to find out which restaurant and takeaway brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

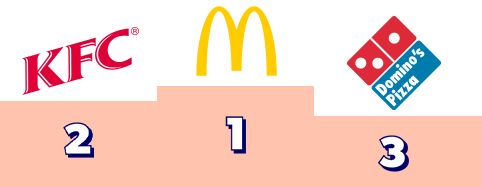

In the restaurant and takeaway sector, along with our winners McDonald’s, this quarter has also been a good one for Greggs and Domino’s, both moving up a place to overtake Subway in our top five.

Domino’s has reported soaring profits from Q2, accredited to their successful campaign around the Euro 2020 football championship. The campaign focused on bringing friends and family back together post-COVID restrictions to watch the football with the essential accompaniment – pizza from Domino’s. The campaign covered all the major marketing touchpoint that influence Gen Z, including TV and radio, digital and social, outdoor ads and more.

Meanwhile, Greggs has been getting rave reviews for its latest vegan alternative product, the meat and dairy-free answer to the popular sausage, cheese and bean melt. The product was praised for being highly realistic, giving vegan customers the chance to enjoy a Greggs classic for the first time, and encouraging non-vegans to try this more ethical alternative.

While young people feel strongly about protecting the environment, ethical food products are often more expensive and harder to get hold of, which makes it difficult to adhere to their principles. Greggs proves it is possible to cater to this market without charging them more than the meat-eaters.

Only 5% of our panel of 16-24s said they would not spend at any of the restaurants listed this quarter. This shows that the return to dining out is in full swing post-COVID, and meeting at restaurants or grabbing a takeaway for a night in with friends is definitely key to Gen Z’s summer plans.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 98% | 72% | 66% | 59% | 100 |

| 2 | KFC | 97% | 53% | 49% | 53% | 90 |

| 3 | Domino’s | 97% | 48% | 42% | 52% | 78 |

| 4 | Greggs | 96% | 47% | 47% | 51% | 65 |

| =5 | Subway | 96% | 44% | 41% | 47% | 60 |

| =5 | Nando’s | 96% | 36% | 41% | 50% | 49 |

| 7 | Starbucks | 96% | 41% | 38% | 46% | 46 |

| 8 | Costa Coffee | 95% | 41% | 37% | 45% | 30 |

| 9 | Pizza Hut | 96% | 31% | 31% | 43% | 23 |

| 10 | Krispy Kreme | 88% | 27% | 26% | 42% | 10 |

Tech & Mobile

We polled over 1,000 young people to find out which tech & mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

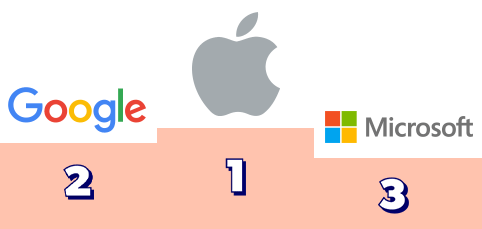

There’s a tie at the top as Google catches up with last quarter’s winner Apple in the tech and mobile category. Google has the edge on brand visibility and engagement, which is no surprise when they’re the go-to for search, maps, and many other online activities. Meanwhile, Apple has stronger purchase intent and brand advocacy, which means young people are more likely to buy from and recommend the brand to their friends.

Apple is doing a particularly good job of converting those who engage with the brand into customers. 68% of those who have engaged with Apple in the past three months told us they intend to purchase from them in the next three months. For each of the other tech and mobile brands, the equivalent figures sit between 46% and 59%. Apple is renowned for its ability to generate brand loyalty, and early signs suggest that this won’t change with the new generation of customers. A recent survey of Student Beans users found that 96% of students will stay loyal to a brand if it offers quality products, and 83% if it has good customer service – both things Apple is known for.

Across the tech and mobile sector as a whole, we’ve seen a slight decrease in purchase intent and engagement compared to the previous quarter. This may be a result of summer coming along and COVID restrictions lifting, meaning students are spending less time at home on their devices. However, we expect to see a boost over the coming months as we reach Back to School season, with students picking up new laptops, phones and tech accessories in preparation for the new academic year.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| =1 | Apple | 92% | 57% | 45% | 58% | 95 |

| =1 | 94% | 61% | 38% | 54% | 95 | |

| 3 | Microsoft | 90% | 36% | 27% | 38% | 71 |

| 4 | Best Buy | 90% | 33% | 29% | 39% | 70 |

| 5 | Samsung | 90% | 32% | 23% | 33% | 61 |

| 6 | T-mobile | 90% | 31% | 23% | 28% | 53 |

| 7 | Verizon | 90% | 30% | 22% | 33% | 41 |

| 8 | AT&T | 88% | 30% | 20% | 31% | 31 |

| 9 | Sony | 88% | 26% | 19% | 28% | 23 |

| 10 | Xfinity | 73% | 24% | 18% | 24% | 10 |

Tech & Mobile

We polled over 1,000 young people to find out which tech and mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Apple and Google retain the top two spots in our tech and mobile chart this quarter, with Apple staying strong in first place. The two tech giants are neck and neck when it comes to brand visibility and engagement, but it’s purchase intent and brand advocacy that give Apple the edge. Apple is known for having very loyal customers, and our research suggests this will not change with Gen Z, the new generation of consumers entering the market. Not only is purchase intent remarkably high for a brand that sells products at a higher price point than most competitors, but they’re also way ahead of the pack in terms of young people feeling comfortable recommending their products to their friends.

While the tech sector as a whole is typically associated with and marketed to the male consumer, Apple is one of the few brands in this category that scores higher with female 16-24s. 82% of female survey respondents had engaged with the brand in the past quarter, versus 60% of their male peers. Stylish design and an aspirational brand give Apple products a broader appeal compared to those of Microsoft, for example, where 50% of males have engaged in the past three months, compared to just 35% of females.

New to the top 10 this quarter is Sony, which comes in joint eighth place with mobile network O2. This comes at the same time as the company reports an impressive 26% growth in Q2 operating profits compared to the same period last year. This success has been attributed to demand for home entertainment, and especially the PlayStation 5, one of the most sought after products for Gen Z at the moment.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Apple | 97% | 60% | 45% | 60% | 99 |

| 2 | 97% | 60% | 30% | 51% | 91 | |

| 3 | Microsoft | 95% | 42% | 23% | 40% | 75 |

| 4 | Samsung | 95% | 30% | 21% | 37% | 63 |

| 5 | Sky | 94% | 35% | 22% | 34% | 60 |

| 6 | Currys PC World | 92% | 28% | 25% | 36% | 55 |

| 7 | EE | 92% | 29% | 22% | 29% | 43 |

| =8 | O2 | 91% | 24% | 18% | 27% | 25 |

| =8 | Sony | 94% | 22% | 16% | 28% | 25 |

| 10 | BT | 91% | 23% | 16% | 25% | 15 |

Food & Drink

We polled over 1,000 young people to find out which food and drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Doritos overtakes Oreo to regain the no.1 spot in the food and drink sector this quarter. Doritos managed to increase their score on every metric we tracked, achieving an overall Youth Affinity Score of 98, equal to their previous best. Doritos is a snack typically associated with social situations and gatherings such as parties, which are of course on the rise as COVID restrictions are released. The brand has also been demonstrating its commitment to social causes in recent months, for example through the Sold Black campaign, which spotlights Black innovators and cultural disruptors.

Meanwhile, on TikTok, creators have been taking part in the roulette challenge, where they risk eating extra hot chips from the brand’s Doritos Roulette packets.

The only metric where Doritos didn’t get the highest score was Brand Advocacy, where they were beaten by last quarter’s overall winner, Oreo. In fact, despite falling to no.2 overall, Oreo actually saw an increase in engagement and advocacy. 80% of those who have engaged with the Oreo brand over the past three months are likely to recommend it, a higher percentage than the equivalent for any other brand.

One way that Oreo keeps up this strong engagement is on Twitter, where they give their followers input on which retired flavors to bring back and regularly join in conversations with other brands.

Which brands could be rising up the charts in the future? Pepsi and Hershey’s have a good shot, as those who have engaged with them in the past three months are more likely to purchase from them in the next three months, compared to all other brands in our list except for Doritos. This applies to 75% of those who engaged with Pepsi, and 74% for Hershey.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Doritos | 94% | 62% | 57% | 60% | 98 |

| 2 | Oreo | 92% | 58% | 52% | 62% | 86 |

| 3 | Coca Cola | 93% | 61% | 52% | 56% | 84 |

| 4 | Hershey’s | 92% | 51% | 46% | 56% | 66 |

| 5 | Lay’s | 89% | 54% | 49% | 53% | 61 |

| 6 | Pepsi | 92% | 50% | 44% | 49% | 51 |

| 7 | Reese’s | 90% | 48% | 42% | 53% | 44 |

| =8 | Ben & Jerry’s | 71% | 31% | 32% | 45% | 23 |

| =8 | Nestlé | 80% | 32% | 29% | 37% | 23 |

| 10 | Red Bull | 88% | 30% | 26% | 35% | 15 |

Food & Drink

We polled over 1,000 young people to find out which food and drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

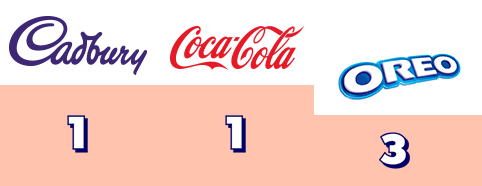

There has been lots of movement in the food and drink top 10 this quarter, including a change at the no.1 spot, which Coca Cola now shares with Cadbury’s (previously in second place). The popularity of Cadbury’s shows that, despite growing up in a time of unlimited choice, this classic British brand has remained relevant and won over the new generation of consumers. Recently their focus on developing new products under existing brand names has launched many new hits, from Dairy Milk Brownie Bites to Bourneville Buttons. On a more experimental note, they have also brought a popular product in Australia and New Zealand, the Caramilk bar, over to the UK this summer.

Another brand moving up our food and drink chart is Ben & Jerry’s, which overtook Galaxy to reach no. 7. This is undoubtedly led by growing demand for ice cream during the summer months, but the brand also resonates with Gen Z due to its strong ethical stance and willingness to take a stand on political issues, even if it risks losing sales. For example, Ben & Jerry’s recently announced it would not sell its products in occupied Palestinian territories, as they stated this was not in line with their company values.

73% of those who have interacted with Ben & Jerry’s intend to make a purchase from them in the next three months, an impressive sign of brand loyalty.

As a whole, visibility, engagement, purchase intent and advocacy slightly declined across the food and drink sector this quarter. This could be attributed to the reopening of restaurants and cafés, with more meals eaten out cutting into sales of treats typically enjoyed at home. These brands will need to look to innovative new products and exciting marketing campaigns to turn this trajectory around ahead of Q4.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| =1 | Cadbury’s | 95% | 61% | 59% | 61% | 89 |

| =1 | Coca Cola | 96% | 64% | 58% | 56% | 89 |

| 3 | Oreo | 96% | 53% | 47% | 56% | 73 |

| 4 | Pepsi | 96% | 55% | 49% | 51% | 66 |

| 5 | Walkers | 94% | 56% | 53% | 51% | 58 |

| 6 | Galaxy | 95% | 47% | 44% | 53% | 49 |

| 7 | Ben & Jerry’s | 93% | 46% | 46% | 59% | 45 |

| 8 | Maltesers | 93% | 47% | 42% | 52% | 33 |

| 9 | Heinz | 92% | 49% | 45% | 45% | 30 |

| 10 | Red Bull | 95% | 37% | 34% | 38% | 20 |

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Quarterly Commentary

Q3 2021

Welcome to the fourth edition of the quarterly Youth Brand Affinity Index from Student Beans, tracking the performance of the biggest Gen Z brands throughout the year.

This report features the results of a survey of 1000 US 16-24s, who gave us their feedback on the top 10 brands leading the way in the 10 sectors most relevant to young people today. We asked our panel which of the brands they recognized, which they had engaged with in the past quarter, which they expect to purchase from this quarter, and which they would recommend to a friend. This data is aggregated to generate a Youth Affinity Score for each brand, and a ranking of the top 10 brands in each sector.

If your brand is featured in the report, this is your chance to get honest feedback from the valuable Gen Z consumer demographic, and understand how your youth marketing efforts are performing against those of your direct competitors. If your brand isn’t featured, take this opportunity to learn from those who are winning with this important audience. What campaigns, ideas and initiatives are working for them, and of those, which could be implemented to drive more success within your own Gen Z marketing strategy?

Methodology

This report contains the results of a survey of 1000 young people aged 16-24. We used panel provider Cint to reach a nationally representative panel, in line with US census data. The survey took place in July 2021

For each sector, we provided our respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

These four metrics were combined to calculate a Youth Affinity Score for each brand, which we have used to create a ranking of the top 10 in each sector.

Quarterly Commentary

Q3 2021

Welcome to the fourth edition of the quarterly Youth Brand Affinity Index from Student Beans, tracking the performance of the biggest Gen Z brands throughout the year. This report features the results of a survey of 1000 UK 16-24s, who gave us their feedback on the top 10 brands leading the way in the 10 sectors most relevant to young people today.

If your brand is featured in the report, this is your chance to get honest feedback from the valuable Gen Z consumer demographic and understand how your youth marketing efforts are performing against those of your direct competitors. If your brand isn’t featured, take this opportunity to learn from those who are winning with this important audience. What campaigns, ideas and initiatives are working for them, and of those, which could be implemented to drive more success within your own Gen Z marketing strategy?

This quarter, we’ve seen some sectors thriving in the wake of COVID restrictions lifting and physical stores reopening, such as high street fashion, health and fitness. However, other sectors are struggling during the summer months. Our research shows an overall decline in brand engagement and purchase intent for several product categories, including online fashion and food and drink. While our day-to-day lives are feeling increasingly normal, the impact of COVID continues for many retailers, and with labour shortages also affecting several sectors, brands will need to tap into innovative solutions and inspiring marketing campaigns to drive stronger results in the quarter ahead.

Methodology

This report contains the results of a survey of 1000 young people aged 16-24. We used panel provider Cint to reach a nationally representative panel, in line with UK census data. The survey took place in July 2021.

For each sector, we provided our respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

These four metrics were combined to calculate a Youth Affinity Score for each brand, which we have used to create a ranking of the top 10 in each sector.