Youth brand affinity tracker

US Edition

UK Edition

Each quarter, we analyze the performance of leading brands in 10 of the sectors most important to Gen Z consumers.

To compile the Youth Brand Affinity Tracker, we look at four key metrics: Brand visibility, brand engagement, purchase intent & brand advocacy.

Fashion

We polled over 1,000 young people to find out which fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

The big story in our fashion top 10 this quarter is American Eagle and its sister brand Aerie, rising from fifth to second place thanks to a growth in brand visibility and advocacy. American Eagle has been praised by market analysts for how it has integrated its physical and digital retail offering and has managed to compete with online-first fashion stores that instinctively understand ecommerce. Online profits reportedly make up around 1/3 of its revenue. Meanwhile, the Aerie brand has helped the business position itself as inclusive and forward-thinking thanks to its activewear and lingerie which caters to a wide range of sizes, and its marketing which embraces body positivity.

Topping our chart for the second quarter in a row, Old Navy is also leading with body positivity, recently launching its ONLY (Old Navy Loves You) line of underwear and loungewear.

In contrast, a brand that has been called out for being out of touch in relation to Gen Z values is Victoria’s Secret, which slips from third place to sixth this quarter. Victoria’s Secret has traditionally been an aspirational brand for young female consumers, but it’s now faced with the challenge of adapting to meet their changing aspirations – to feel confident in their own body and embrace their individuality, rather than conform to an idealized look or body shape. Victoria’s Secret is tackling this with a rebrand, which its CEO states is focused on “including all women.” Changes so far have included replacing the Victoria’s Secret Angels with a new group of inspirational women, the VS Collective. Time will tell whether the brand can regain its popularity and return to our fashion top five.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Old Navy | 95% | 30% | 25% | 40% | 84 |

| 2 | American Eagle / Aerie | 89% | 30% | 26% | 41% | 79 |

| 3 | H&M | 87% | 31% | 27% | 37% | 76 |

| 4 | Shein | 67% | 32% | 29% | 32% | 68 |

| 5 | Forever 21 | 91% | 28% | 24% | 33% | 65 |

| 6 | Victoria’s Secret | 93% | 26% | 24% | 35% | 64 |

| 7 | Hollister | 87% | 19% | 15% | 28% | 39 |

| 8 | Urban Outfitters | 81% | 18% | 16% | 27% | 34 |

| 9 | Gap | 90% | 15% | 12% | 24% | 33 |

| 10 | Fashion Nova | 61% | 12% | 10% | 27% | 10 |

Fashion – Retail

We polled over 1,000 young people to find out which in store fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

For the second quarter in a row, there’s a tie at the top in the in-store fashion category between two very different brands: Nike and Primark. While Nike has the edge in brand visibility and brand advocacy, demonstrating its aspirational value to young consumers, 16-24s are much more likely to have bought from or plan to buy from Primark within the next three months.

Always ahead of the trends, Nike recently announced the launch of its new Metaverse Studio, with a vision to create virtual Nike-branded products. The business applied to patent its name, logo and “just do it” slogan for use “in online virtual worlds,” and they’ve begun hiring for virtual material designers. Already known for the technology that sets its product design apart from competitors, it’s no surprise to see Nike investing in the metaverse before other clothing brands recognise its potential.

Elsewhere in our chart, it’s been a good quarter for H&M, which moved up two spots from fifth to third place. The Swedish retailer has increasingly put its ethics and values at the centre of its business strategy. Recent initiatives have included launching a range of sustainable partywear ahead of the festive season. They also demonstrated their commitment to being eco-friendly by announcing they would not work with any new suppliers who rely on coal. Actions like this show ethically-minded consumers that the brand’s dedication to sustainability goes far beyond a marketing strategy.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1= | Nike | 97% | 43% | 23% | 52% | 93 |

| 1= | Primark | 94% | 58% | 51% | 51% | 93 |

| 3 | H&M | 92% | 43% | 35% | 44% | 78 |

| 4 | Adidas | 95% | 32% | 27% | 42% | 63 |

| 5 | JD Sports | 91% | 41% | 30% | 43% | 55 |

| 6 | Sports Direct | 92% | 33% | 25% | 35% | 40 |

| 7 | New Look | 85% | 34% | 25% | 32% | 40 |

| 8= | Next | 91% | 23% | 20% | 29% | 28 |

| 8= | Zara | 81% | 26% | 23% | 33% | 28 |

| 10 | Footlocker | 83% | 20% | 20% | 27% | 13 |

Sports & Athleisure

We polled over 1,000 young people to find out which sports & athleisure brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s no change at the top in the sports and athleisure category as Nike retains first place. Always ahead of the trends, Nike recently announced the launch of its new Metaverse Studio, with a vision to create virtual Nike-branded products. The business applied to patent its name, logo and “just do it” slogan for use “in online virtual worlds,” and they’ve begun hiring for virtual material designers. Already known for the technology that sets its product design apart from competitors, it’s no surprise to see Nike investing in the metaverse before other clothing brands recognize its potential.

On the rise this quarter is Adidas, which boosted its scores across the visibility, engagement, and intent metrics and overtook Vans after sharing second place with the skate shoe brand last time. Adidas has gotten a lot of attention for its partnership with Kanye West’s brand Yeezy. Kanye has had a relationship with Adidas since 2014, and they have collaborated to release some very unique and highly collectible products, including the brand new Yeezy boots in the style of a puffer jacket.

Elsewhere in the top 10, Under Armour has climbed into the top five for the first time, overtaking Footlocker. Under Armour saw a jump in its stock price recently after reporting a strong third quarter, which the company’s CEO attributed to “demand for the Under Armour brand and our ability to execute quickly to meet the needs of our consumers.” The business has also been focusing on growing its ecommerce sales and doubling down on popular product categories such as running wear.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Nike | 99% | 60% | 53% | 70% | 100 |

| 2 | Adidas | 98% | 41% | 33% | 56% | 90 |

| 3 | Vans | 95% | 33% | 29% | 48% | 80 |

| 4 | Converse | 93% | 25% | 22% | 44% | 68 |

| 5 | Under Armour | 92% | 25% | 20% | 39% | 59 |

| 6 | The North Face | 83% | 19% | 19% | 38% | 44 |

| 7 | Footlocker | 90% | 19% | 16% | 29% | 41 |

| 8 | Puma | 93% | 14% | 11% | 24% | 39 |

| 9 | Gymshark | 47% | 9% | 9% | 16% | 16 |

| 10 | Fabletics | 54% | 9% | 8% | 15% | 14 |

Fashion – Ecommerce

We polled over 1,000 young people to find out which ecommerce fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

ASOS takes the crown among online fashion brands again this quarter, scoring higher than any competitor on each of our metrics. However, the retailer is facing a challenging few months ahead as it approaches the festive season dealing with stock shortages and delivery delays. The supply chain crisis has affected brands across many sectors, but it’s a particular concern for ASOS and other fashion ecommerce companies who are loved by young consumers for the speedy delivery and easy returns process they usually offer, enabling them to make last minute purchases for a big night out. Could this issue lead shoppers to return to the high street for their Christmas party outfits this year?

Another big story we’ve been following this year is the growth of Chinese ecommerce brand Shein, which remarkably overtook Amazon as the most popular retail app in the US a few months ago. Its meteoric rise has also been evident in our Youth Brand Affinity Index, where Shein has flown up the charts. It currently ranks joint-second with British rival Boohoo, having moved up from fourth place when we first conducted this research in Q4 2020. At the time, only 44% of 16-24s were aware of the brand, compared to 74% a year later.

Shein’s rise could be under threat following a recently published independent report alleging that the business uses suppliers who violate labour laws, with employees reportedly working 75-hour weeks in buildings without fire exits or even windows. Shein responded by launching an investigation into the claims. While workers’ rights are among the issues Gen Z are passionate about, we know price is a key factor determining purchase decisions. If these issues aren’t resolved, they will force Gen Z shoppers to make a decision between their values and consumer desires.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | ASOS | 85% | 44% | 39% | 47% | 100 |

| 2= | Boohoo | 80% | 36% | 27% | 31% | 84 |

| 2= | Shein | 74% | 36% | 30% | 34% | 84 |

| 4 | Pretty Little Thing | 79% | 31% | 26% | 27% | 73 |

| 5 | Depop | 71% | 25% | 21% | 26% | 58 |

| 6 | Gymshark | 74% | 18% | 19% | 25% | 50 |

| 7 | Missguided | 68% | 22% | 15% | 24% | 43 |

| 8 | I Saw It First | 49% | 15% | 12% | 17% | 29 |

| 9 | Nasty Gal | 49% | 13% | 9% | 15% | 21 |

| 10 | In The Style | 34% | 9% | 8% | 10% | 10 |

Retail

We polled over 1,000 young people to find out which retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Amazon takes the win in our general retail category this quarter, and it’s no surprise that purchase intent is high, with Black Friday and the holiday season coming up in the next three months. The company recently reported lower than expected Q3 earnings, which was blamed on supply chain issues, so there will be a major focus on these pivotal shopping events to get annual takings back on track. In fact, they had already begun launching their first Black Friday deals for 2021 as early as October.

Another brand that looks likely to perform well this festive season is TJ Maxx, which scores higher than any other retailer except Amazon on the important purchase intent metric, and has overtaken Bed Bath & Beyond to reach no.4 in the top 10. Research by Citi found that TJ Maxx was the brand that shoppers are most likely to increase their spend on this Black Friday, while Wells Fargo named TJ Maxx as one of the businesses best positioned to weather the supply chain challenges.

In a recent survey of Student Beans users, we heard that 44% of them spent less than usual on Black Friday 2020 due to the impact of COVID-19, with 37% maintaining usual spending and 19% spending more. With the majority of this demographic now being vaccinated (77% of our users had received at least one dose as of September) and physical retail fully reopened, we can expect a boom in in-store shopping this year as young consumers are excited to get back to their holiday traditions.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 99% | 85% | 82% | 77% | 100 |

| 2 | Home Depot | 97% | 32% | 20% | 41% | 83 |

| 3 | eBay | 97% | 30% | 23% | 33% | 75 |

| 4 | TJ Maxx | 89% | 29% | 26% | 38% | 63 |

| 5 | Bed Bath & Beyond | 93% | 26% | 20% | 39% | 61 |

| 6 | Macy’s | 95% | 24% | 19% | 33% | 51 |

| 7 | Kohls | 93% | 25% | 19% | 31% | 44 |

| 8 | JC Penney | 95% | 21% | 14% | 27% | 36 |

| 9 | Lowe’s | 93% | 20% | 13% | 29% | 28 |

| 10 | Nordstrom | 78% | 13% | 12% | 22% | 10 |

Retail

We polled over 1,000 young people to find out which retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Amazon takes the win in our general retail category this quarter, and it’s no surprise that purchase intent is high, with Black Friday and the holiday season taking place in Q4. The company recently reported lower than expected Q3 earnings, which was blamed on supply chain issues, so there will be a major focus on these pivotal shopping events to get annual takings back on track. In fact, they had already begun launching their first Black Friday deals for 2021 as early as October.

One brand on its way up this quarter is WHSmith, which overtakes Wilko to reach no. 7 in our chart, thanks to growth in brand engagement and purchase intent. A high street staple for many decades, WHSmith isn’t a business that’s typically associated with Gen Z, but it is a great place to shop for study essentials like books and stationery. As students returned to in-person classes in recent months, there’s been a sudden resurgence in need for these items, which it seems WHSmith has benefited from.

Another brand that stands out in this sector is B&M, which makes it into our top five despite having much lower brand awareness than most other competitors in our list. The retailer was among those that thrived during the pandemic, as it was able to remain open during lockdown, and in September 2020 announced it would open 45 new stores in the year ahead. With its affordable prices and range of useful items for those living away from home for the first time, it’s easy to see why B&M has become a student favourite.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 96% | 75% | 68% | 65% | 100 |

| 2 | eBay | 96% | 47% | 37% | 40% | 85 |

| 3 | Argos | 94% | 34% | 29% | 44% | 70 |

| 4= | B&M | 82% | 35% | 28% | 39% | 55 |

| 4= | IKEA | 95% | 33% | 24% | 44% | 55 |

| 6 | M&S | 93% | 35% | 27% | 35% | 54 |

| 7 | WHSmith | 91% | 35% | 23% | 36% | 46 |

| 8 | Wilko | 82% | 33% | 26% | 35% | 34 |

| 9 | TK Maxx | 88% | 33% | 26% | 34% | 29 |

| 10 | Etsy | 76% | 30% | 25% | 36% | 23 |

Grocery

We polled over 1,000 young people to find out which grocery brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s a change at the top in the grocery sector this quarter for the first time since we began the Youth Brand Affinity Index, as Target joins Walmart in first place, each receiving an overall Youth Affinity Score of 95. While Walmart won over Target in the spend-related metrics of brand engagement and purchase intent, Target was ahead in visibility and advocacy, demonstrating the effectiveness of its marketing to young consumers. While Walmart has significantly more stores across the nation, Target clearly has more of a place in the hearts of this demographic of shoppers.

Target appeals to Gen Z for a similar reason to Amazon: convenience. It’s a “one-stop-shop” where you can buy much more than groceries, and its consistent popularity in our chart every quarter shows that this demographic aren’t put off by the fact that it’s not purely a grocery specialist. Being able to pick up other essential items or even gifts and treats within one store is a great benefit for young people today, who are busier than ever with school, work and other activities.

96% of the 16-24s who responded to our survey had engaged with at least one of the brands listed within the past three months. This should be a reminder that even those students and young people who live at their family home shop from grocery stores, and it’s important to include them in your marketing strategy to generate loyalty that will last as they continue into adulthood and their spending power grows.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1= | Target | 99% | 73% | 67% | 71% | 95 |

| 2= | Walmart | 98% | 80% | 75% | 62% | 95 |

| 3 | CostCo | 90% | 32% | 30% | 43% | 74 |

| 4 | 7-Eleven | 95% | 36% | 30% | 31% | 69 |

| 5 | Trader Joe’s | 84% | 24% | 22% | 36% | 55 |

| 6 | Aldi | 72% | 27% | 23% | 33% | 54 |

| 7 | Whole Foods Market | 86% | 21% | 20% | 33% | 44 |

| 8 | Kroger | 71% | 23% | 21% | 24% | 35 |

| 9 | Publix | 53% | 15% | 13% | 20% | 20 |

| 10 | Safeway | 52% | 13% | 13% | 14% | 10 |

Supermarkets

We polled over 1,000 young people to find out which supermarkets resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Gen Z are known for championing challenger brands, and they’ve done just that in the supermarket sector. This quarter we see Aldi entering the top three, overtaking Sainsbury’s for the first time since we began tracking brand affinity among 16-24s. This is a particularly significant achievement since Sainsbury’s is well established as one of the “big three” supermarkets, along with category leaders Tesco and ASDA.

Along with another fast-growing German supermarket chain Lidl, Aldi has won over young shoppers with its affordable prices, wide variety of products, and its fun marketing campaigns. The retailer is always on the lookout for trends to get involved with and regularly makes headlines with attention-grabbing new products, from its espresso martini cheese to its wine advent calendar. They’ve also secured a partnership with one of the biggest Gen Z stars for their 2021 Christmas campaign – Marcus Rashford can be heard voicing Marcus the Radish in their festive ad. The footballer chose to work with the brand because of their efforts to tackle child poverty, an issue he’s famously passionate about.

As for our Q4 winners Tesco, the biggest of the British supermarkets is one of many businesses getting ready for a challenging Christmas amid expected stock shortages due to the supply chain crisis. The issue could drive shoppers to experiment with new brands this quarter as they look further afield to find their festive essentials, so we’ll be intrigued to see how this may impact the results of our research next quarter.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Tesco | 96% | 69% | 65% | 59% | 100 |

| 2 | ASDA | 95% | 51% | 47% | 48% | 85 |

| 3 | Aldi | 96% | 48% | 42% | 46% | 76 |

| 4 | Sainsbury’s | 95% | 52% | 45% | 43% | 73 |

| 5 | Lidl | 95% | 42% | 39% | 46% | 64 |

| 6= | Co-op | 92% | 45% | 32% | 34% | 45 |

| 6= | Morrison’s | 94% | 88% | 30% | 37% | 45 |

| 8 | Iceland | 92% | 33% | 28% | 32% | 33 |

| 9 | Waitrose | 87% | 14% | 18% | 22% | 18 |

| 10 | Spar | 71% | 15% | 13% | 15% | 13 |

Entertainment

We polled over 1,000 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s disruption in the entertainment chart this quarter as Netflix overtakes YouTube to take the no.1 spot for the first time since Q4 2020. The streaming service celebrated an unexpected hit with the release of the dystopian Korean drama Squid Game in September. The show was watched by more than 142 million households in its first four weeks, beating previous record-holder Bridgerton to become the most-watched series in Netflix history. The company is also gearing up for a big holiday season, with 23 Christmas films and series released in November.

Slipping down the chart this quarter is Apple Music, which moved to 10th position due to a decline in purchase intent and brand advocacy. Although Apple Music got off to an impressive start when it launched in 2015, gaining 10 million subscribers in its first six months, six years later it’s still far behind its main competitor Spotify, with 60 million subscribers compared to Spotify’s 155 million paying customers. As customers become increasingly overwhelmed by the range of streaming services available, Apple Music could benefit from the desire for one simple bundle covering all their entertainment needs, for example the Apple One subscription comprising of Apple Music, TV, News, Arcade, and more.

Elsewhere in the chart, we see Disney+ and Hulu swap places with an increase in brand engagement for the latter enabling it to overtake its newer rival. However, brand advocacy has dropped for both brands, while it has risen almost 10% for category leader Netflix. Therefore, both Hulu and Disney+ will be looking for a hit to match the huge success of Squid Game in the months ahead.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Netflix | 99% | 83% | 56% | 75% | 98 |

| 2 | YouTube | 99% | 89% | 36% | 74% | 83 |

| 3 | Spotify | 97% | 65% | 44% | 62% | 76 |

| 4 | Hulu | 97% | 61% | 39% | 55% | 68 |

| 5 | Disney+ | 97% | 54% | 37% | 55% | 60 |

| 6 | Prime Video | 97% | 57% | 36% | 49% | 56 |

| 7 | Playstation | 97% | 33% | 22% | 37% | 35 |

| 8 | Nintendo | 96% | 35% | 24% | 42% | 34 |

| 9 | Xbox | 97% | 32% | 22% | 35% | 29 |

| 10 | Apple Music | 96% | 32% | 22% | 34% | 16 |

Entertainment

We polled over 1,000 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Winners in the entertainment category this quarter, Netflix celebrated an unexpected hit with the release of the dystopian Korean drama Squid Game in September. The show was watched by more than 142 million households in its first four weeks, beating previous record-holder Bridgerton to become the most-watched series in Netflix history. The company is also gearing up for a big holiday season, with 23 Christmas films and series released in November.

Slipping down the chart this quarter is Apple Music, which moved from eighth to ninth position due to a decline across all metrics, but particularly purchase intent and brand engagement. Although Apple Music got off to an impressive start when it launched in 2015, gaining 10 million subscribers in its first six months, six years later it’s still far behind its main competitor Spotify, with 60 million subscribers compared to Spotify’s 155 million paying customers. As customers become increasingly overwhelmed by the range of streaming services available, Apple Music could benefit from the desire for one simple bundle covering all their entertainment needs, for example the Apple One subscription comprising Apple Music, TV, News, Arcade, and more.

A new addition to our top 10 is Amazon Prime Video, which comes in at no.4. Engagement is high for this brand as its inclusion in Amazon’s Student Prime offer makes it more accessible to young consumers. However, advocacy is lower than competitors such as Netflix and Disney+, showing that the streaming service isn’t delivering enough exciting, relevant content to inspire the younger audience.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Netflix | 98% | 77% | 54% | 69% | 95 |

| 2 | YouTube | 98% | 81% | 37% | 65% | 93 |

| 3 | Spotify | 97% | 65% | 42% | 59% | 83 |

| 4 | Amazon Prime Video | 95% | 52% | 35% | 45% | 64 |

| 5 | Disney+ | 95% | 45% | 33% | 47% | 58 |

| 6 | Playstation | 96% | 35% | 27% | 37% | 53 |

| 7 | Xbox | 95% | 32% | 23% | 32% | 40 |

| 8 | Nintendo | 94% | 32% | 23% | 38% | 36 |

| 9 | Apple Music | 91% | 25% | 18% | 27% | 20 |

| 10 | Game | 79% | 20% | 17% | 26% | 10 |

Travel

We polled over 1,000 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

It has been a tumultuous year for the travel industry, but stability seems to be back on the map as we’ve seen little change in our top 10 compared to Q3. As we have seen consistently since we began measuring brand affinity last year, the winners in this sector are those newer brands that represent the leaders in the sharing economy: Uber, Lyft and Airbnb. Their continued popularity demonstrates that as young people enter a “new normal” and return to travel post-COVID, they are comfortable returning to these services, which could have been slower to bounce back due to safety concerns.

Uber has been in the news recently as a shortage of drivers has led to a surge in prices and wait times for customers. However, brand advocacy has actually increased 5% compared to Q3, proving that these issues have not (yet) had a negative impact on how young consumers perceive Uber. Top competitor Lyft stayed consistent with a brand advocacy score of 34%, while Airbnb saw a smaller increase of 2% quarter-on-quarter.

We also see an interesting pattern among airline brands, where Delta and Southwest rank highest on brand advocacy, but are beaten by American Airlines on all other metrics. This suggests that while young people are spending with American Airlines, they don’t view the brand as positively as some of its key competitors. Indeed, a recent survey of Student Beans users found that they viewed Delta as better value for money and cooler than American Airlines, as well as stating that it offers a better standard of service.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 97% | 42% | 39% | 52% | 100 |

| 2 | Lyft | 92% | 25% | 23% | 34% | 88 |

| 3 | Airbnb | 89% | 23% | 18% | 39% | 80 |

| 4 | American Airlines | 91% | 16% | 13% | 24% | 68 |

| 5 | Delta | 87% | 15% | 11% | 28% | 59 |

| 6 | Southwest Airlines | 81% | 14% | 11% | 25% | 49 |

| 7 | United Airlines | 88% | 12% | 10% | 20% | 39 |

| 8 | TripAdvisor | 83% | 13% | 8% | 22% | 35 |

| 9 | Expedia | 73% | 12% | 8% | 17% | 24 |

| 10 | Booking.com | 62% | 10% | 7% | 16% | 10 |

Travel

We polled over 1,000 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

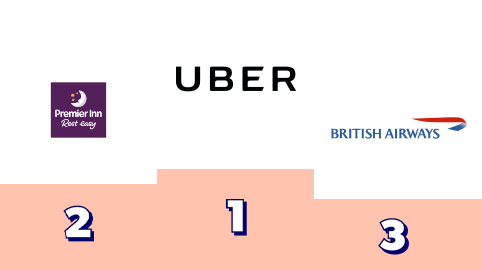

There’s no change at the top in the travel sector as ride-sharing service Uber retains the top spot. Uber has been in the news recently as a shortage of drivers has led to a surge in prices and wait times for customers. However, brand advocacy has actually increased 6% compared to Q3, proving that these issues have not (yet) had a negative impact on how young consumers perceive Uber. There were similar increases for the brand across each of the other metrics we track, including engagement and purchase intent, showing that as young people are increasingly returning to nightlife, events and other social activities, they are returning to Uber as well. With the festive party season on the horizon, the coming months hold great promise for Uber, even if driver shortages do cause prices to rise.

Another travel brand that has had a good 2021 is Travelodge, which jumps from ninth to joint sixth place this quarter, increasing their Youth Affinity Score by an impressive 15 points. They have benefited from the increase in Brits taking holidays within the UK due to international travel restrictions, and following a tough 2020 for the sector, were able to open 17 new hotels this year.

According to a recent survey of Student Beans users, we know that 74% of students who live away from their family home during term time will be heading home for Christmas. Brands such as Travelodge and their leading competitor Premier Inn could benefit from this, as students remain cautious about sharing family homes with vulnerable relatives, or take advantage of their time off to visit friends and family in different parts of the country.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 95% | 42% | 45% | 48% | 100 |

| 2 | Premier Inn | 89% | 22% | 21% | 33% | 80 |

| 3 | British Airways | 91% | 21% | 17% | 32% | 74 |

| 4 | Booking.com | 76% | 27% | 24% | 30% | 70 |

| 5 | Airbnb | 81% | 21% | 17% | 29% | 56 |

| 6= | EasyJet | 89% | 18% | 15% | 26% | 48 |

| 6= | Travelodge | 85% | 20% | 15% | 25% | 48 |

| 8 | National Express | 74% | 19% | 17% | 12% | 40 |

| 9 | RyanAir | 81% | 17% | 14% | 20% | 25 |

| 10 | TUI | 67% | 11% | 10% | 17% | 10 |

Health & Beauty

We polled over 1,000 young people to find out which health & beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s a new leader in the health and beauty sector this quarter, with CVS overtaking Walgreens for the first time since we began conducting our brand affinity research. The retailer also overtook Bath & Body Works since Q3 and gained 11% on each of the brand engagement and purchase intent metrics. CVS’s success with the Gen Z demographic reflects its wider performance, as the company reported a 10% growth in earnings quarter-on-quarter. The achievement was credited to a combination of retail sales and an increase in prescriptions, along with administering millions of COVID shots and tests across the country.

CVS also won some good press recently when it announced that it was on track to raise its employees’ wages to a minimum of $15 per hour by July 2022. Not only will this affect the many young people working for the company, but moves like this also appeal to the values of Gen Z, for whom workers’ rights is an important issue.

Joining our Youth Brand Affinity Index for the first time this quarter is Maybelline, which enters the chart in eighth place, making it one of the top beauty brands among 16-24s. However, attention should also be paid to e.l.f Cosmetics, which may have far less brand recognition than Maybelline (54% vs. 73%) but places higher in our chart as it performs better on the three other metrics: engagement, purchase intent and advocacy. Along with NYX and CeraVe, e.l.f Cosmetics is one of a newer breed of beauty brands strongly associated with TikTok, which has helped them to win a loyal Gen Z following.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | CVS | 95% | 55% | 50% | 52% | 99 |

| 2 | Walgreens | 95% | 53% | 46% | 50% | 91 |

| 3 | Bath & Body Works | 93% | 38% | 35% | 49% | 80 |

| 4 | Ulta Beauty | 76% | 27% | 24% | 37% | 65 |

| 5 | Sephora | 80% | 22% | 20% | 35% | 60 |

| 6 | e.l.f Cosmetics | 54% | 20% | 16% | 27% | 40 |

| 7 | L’Oreal | 81% | 17% | 11% | 23% | 39 |

| 8 | Maybelline | 73% | 17% | 14% | 24% | 36 |

| 9 | Rite Aid Corporation | 62% | 16% | 15% | 20% | 28 |

| 10 | MAC | 60% | 9% | 8% | 19% | 13 |

Health & Beauty

We polled over 1,000 young people to find out which health & beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s great news for Boots this quarter as not only has the pharmacy chain retained its place at no.1 in our health & beauty chart, but it’s also increased its scores across three important metrics: brand engagement, purchase intent and brand advocacy. One reason young shoppers keep coming back to Boots is their loyalty scheme, the Boots Advantage Card, which was voted as the best of its kind in a survey we conducted of Student Beans users this year. Brands that demonstrate they value their customers by giving discounts to loyal shoppers are always a winner with a generation that loves to feel confident they’ve got the best deal on whatever they choose to buy.

Another brand that saw increases across all the metrics we track is The Body Shop, which also overtook Gillette after being in joint third place last quarter. Founded over 40 years ago, The Body Shop was way ahead of its time as it pioneered the sale of sustainable and cruelty-free beauty products and toiletries on the UK high street. The challenge for the business today is to remain relevant with each new generation of consumers and to capitalise on their established position as a trusted British brand. Their strong performance in our chart shows that they are succeeding in this mission.

It’s notable that, aside from the two biggest high street chains Boots and Superdrug, the retailers with the highest brand advocacy scores in our chart are The Body Shop and Lush, two companies known for their ethical standards. While it can be difficult to shop according to their values in categories such as fashion and travel, Gen Z have many great options for affordable ethical brands in the health and beauty category, including these two industry leaders in the UK.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Boots | 93% | 58% | 52% | 55% | 100 |

| 2 | Superdrug | 89% | 47% | 44% | 49% | 90 |

| 3 | The Body Shop | 83% | 27% | 27% | 37% | 78 |

| 4 | Gillette | 84% | 23% | 19% | 32% | 63 |

| 5= | Holland & Barrett | 78% | 22% | 20% | 31% | 60 |

| 5= | Lush | 71% | 22% | 24% | 36% | 60 |

| 7 | Pure Gym | 69% | 19% | 15% | 20% | 33 |

| 8 | Beauty Bay | 42% | 14% | 16% | 24% | 30 |

| 9 | MAC | 64% | 12% | 11% | 20% | 20 |

| 10 | MyProtein | 43% | 13% | 14% | 17% | 18 |

Restaurants & Takeout

We polled over 1,000 young people to find out which restaurant and takeout brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

McDonald’s holds firm in its position at no.1 in our restaurants and takeout top 10, but it’s interesting to note that the two other brands in the top three outperform it on the brand advocacy metric. This suggests that McDonald’s is winning on affordability and availability but still has a way to go in becoming a brand that young consumers are proud to buy from. Their collaborations with a new generation of internet stars, such as boyband BTS and esports team Faze Clan, have helped to make the brand feel more cool and relevant to young people, but there is clearly still work to do to overhaul their reputation.

In contrast to McDonald’s, brand advocacy is up for Chick-Fil-A compared to last quarter. Of those who said they’d engaged with the brand in the past three months, 85% said they would recommend it to a friend, and 85% plan to purchase from Chick-Fil-A in the next three months. Chick-Fil-A is particularly popular in the south, with more of those who engged with the brand coming from Texas than any other state. During the pandemic when its drive-thru locations were among the only restaurants still open, it struggled to meet demand. As a result, its delivery business has grown dramatically and the company is opening “ghost kitchens” to make sure chicken lovers are served.

Elsewhere in our top 10, it was a good quarter for Dunkin’ Donuts, which moved from eight to sixth place, with a 5% increase in brand visibility demonstrating the impact of its marketing efforts. Recent campaigns have included spider donuts and a peanut butter macchiato launched in the run-up to Halloween.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 99% | 72% | 62% | 51% | 94 |

| 2 | Starbucks | 98% | 61% | 56% | 59% | 80 |

| 3 | Chick-Fil-A | 96% | 57% | 56% | 60% | 71 |

| 4 | Taco Bell | 98% | 49% | 43% | 44% | 59 |

| 5 | Subway | 98% | 44% | 40% | 45% | 55 |

| 6= | Dunkin’ Donuts | 98% | 39% | 37% | 46% | 49 |

| 6= | Wendy’s | 98% | 45% | 38% | 43% | 49 |

| 8= | Chipotle | 95% | 39% | 37% | 45% | 34 |

| 8= | Pizza Hut | 99% | 28% | 26% | 36% | 34 |

| 10 | Burger King | 98% | 35% | 28% | 32% | 26 |

Restaurants & Takeaway

We polled over 1,000 young people to find out which restaurants and takeaway brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

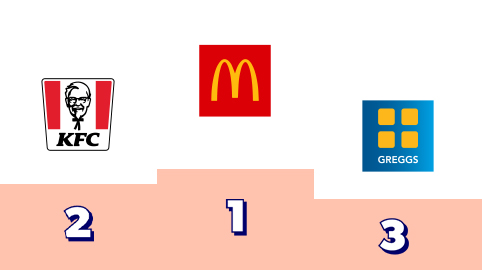

Continuing its run at no.1 in the restaurants and takeaway category is McDonald’s, who recently released their 2021 Christmas advert to great acclaim. The touching ad features a cute character named Imaginary Iggy, and is soundtracked by a new cover of Cyndi Lauper’s Time After Time by pop star Mabel. The singer has agreed to donate 10% of proceeds from the track to Fareshare, McDonald’s charity partner for the campaign, through which they plan to donate 5 million meals to families in need this Christmas. In contrast to the usual lively, jokey tone to its marketing, this more sensitive approach positions McDonald’s as a family-friendly brand that cares about the community.

Moving up in the chart this quarter is Greggs, which rises from fourth to third position. Central to Greggs’ festive marketing strategy this year is the launch of their vegan festive bake, the first time this popular item from the bakery chain has been available to non-meat eaters. For the carnivores, there’s also a new pigs in blankets baguette on the menu. Like McDonald’s, Greggs partners with Student Beans to offer a special offer for students, a free sausage roll or sweet treat with any meal deal. The brand wisely chose its most iconic product as an incentive to encourage students to purchase their lunch from Greggs.

While Greggs and Subway moved up in our chart this quarter, Dominos and Nando’s slipped a few places each. Nando’s saw a particular decline in purchase intent from 41% to 33%. This could be the impact of more young people buying lunch out and about following their return to college or university, and ordering fewer takeaways as they spend more evenings out with friends, dining at restaurants in person.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 98% | 76% | 65% | 61% | 100 |

| 2 | KFC | 97% | 52% | 45% | 49% | 88 |

| 3 | Greggs | 94% | 51% | 45% | 53% | 69 |

| 4 | Subway | 96% | 45% | 40% | 47% | 66 |

| 5 | Domino’s | 96% | 44% | 39% | 49% | 56 |

| 6 | Starbucks | 96% | 30% | 39% | 46% | 54 |

| 7 | Costa Coffee | 95% | 41% | 39% | 43% | 39 |

| 8 | Nando’s | 94% | 34% | 33% | 49% | 38 |

| 9 | Pizza Hut | 96% | 25% | 24% | 39% | 21 |

| 10 | Krispy Kreme | 89% | 28% | 25% | 44% | 20 |

Tech & Mobile

We polled over 1,000 young people to find out which tech and mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

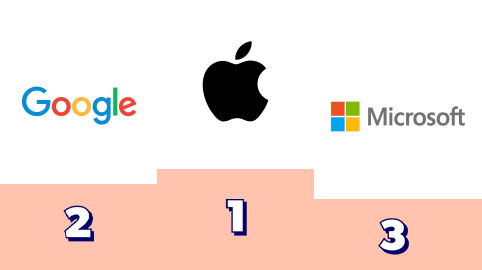

After sharing the spotlight with Google last quarter, Apple is back in first place this time around. Their scores were undoubtedly boosted by the recent release of the iPhone 13, along with the 13 Pro, and 13 Mini. The 13 Pro was described by Apple as having their “biggest camera upgrade ever,” which will certainly appeal to the creative types within the Gen Z audience, along with those who place high importance on their social media image. However, Apple is also making it more accessible for young consumers to own the latest iPhone models by including a lower-priced iPhone Mini in the new range.

Achieving the highest brand advocacy score by a good margin, we know that Apple is a very aspirational brand for Gen Z, but making it affordable is important to ensure young consumers feel it’s relevant and accessible to them. Also performing well on brand advocacy is Google, a business that has gained loyalty from Gen Z through familiarity, having been a constant presence in their lives across products such as search, maps, shopping and more. This creates a feeling of trust that benefits Google when promoting its hardware, such as the popular Pixel phones and the Chromebook, a first laptop for many teens due to its combination of style, functionality, and affordability. Although Apple scores highest for purchase intent, Google is ahead for engagement.

Elsewhere in the top 10, we see Verizon overtaking T-mobile, two brands that Forbes recently described as being in a “telecom war” amid the rollout of 5G. While faster download speeds will appeal to young consumers, affordability and reliability of service are the key decision-making factors when choosing a telecom provider.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Apple | 99% | 69% | 47% | 68% | 96 |

| 2 | 99% | 73% | 32% | 62% | 94 | |

| 3 | Microsoft | 98% | 50% | 25% | 50% | 74 |

| 4 | Best Buy | 98% | 40% | 29% | 49% | 71 |

| 5 | Verizon | 98% | 33% | 19% | 35% | 61 |

| 6 | Samsung | 98% | 25% | 11% | 32% | 41 |

| 7 | AT&T | 97% | 26% | 15% | 24% | 39 |

| 8 | T-mobile | 97% | 27% | 15% | 23% | 36 |

| 9 | Sony | 96% | 22% | 14% | 27% | 28 |

| 10 | Xfinity | 83% | 20% | 13% | 23% | 10 |

Tech & Mobile

We polled over 1,000 young people to find out which tech and mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

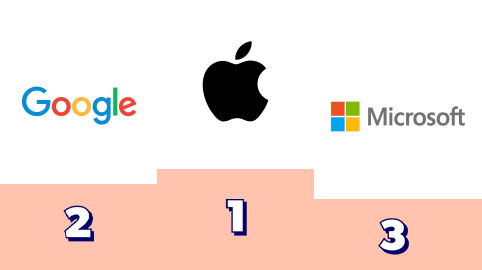

This quarter, Apple holds strong in first place, with their scores undoubtedly getting a boost from the recent release of the iPhone 13, along with the 13 Pro, and 13 Mini. The 13 Pro was described by Apple as having their “biggest camera upgrade ever,” which will certainly appeal to the creative types within the Gen Z audience, along with those who place high importance on their social media image. However, Apple is also making it more accessible for young consumers to own the latest iPhone models by including a lower-priced iPhone Mini in the new range.

Achieving the highest brand advocacy score by a good margin, we know that Apple is a very aspirational brand for Gen Z, but making it affordable is important to ensure young consumers feel it’s relevant and accessible to them. Also performing well on brand advocacy is Google, a business that has gained loyalty from Gen Z through familiarity, having been a constant presence in their lives across products such as search, maps, shopping and more. This creates a feeling of trust that benefits Google when promoting its hardware, such as the popular Pixel phones and the Chromebook, a first laptop for many teens due to its combination of style, functionality, and affordability.

Elsewhere in the chart, O2 slips a couple of places following its recent acquisition by Virgin Media, while Vodafone enters the top 10 and overtakes O2. While the two phone networks score similarly on brand advocacy and visibility, Vodafone is notably ahead on engagement, likely thanks to its youth-focused VOXI brand. Their leading competitor EE, meanwhile, stays firm at no.7 with no change in its Youth Affinity Score this quarter.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Apple | 97% | 60% | 41% | 62% | 96 |

| 2 | 97% | 59% | 28% | 51% | 93 | |

| 3 | Microsoft | 96% | 43% | 21% | 38% | 78 |

| 4 | Samsung | 97% | 29% | 17% | 31% | 61 |

| 5 | Sky | 94% | 30% | 18% | 27% | 58 |

| 6 | Currys PC World | 91% | 27% | 20% | 32% | 53 |

| 7 | EE | 90% | 27% | 19% | 27% | 43 |

| 8 | Sony | 93% | 17% | 14% | 27% | 29 |

| 9 | Vodafone | 92% | 23% | 14% | 23% | 11 |

| 10 | O2 | 90% | 19% | 14% | 24% | 11 |

Food & Drink

We polled over 1,000 young people to find out which food and drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s a new brand at the top of the food and drink chart this quarter as Oreo takes the lead. Q3 winner Doritos falls to no.3, being overtaken not only by Oreo but also Coca Cola. The three brands have changed places every quarter, showing how open this category is to disruption, and the potential for a great marketing campaign or popular product launch to change a brand’s fortunes in the food and drink industry.

Oreo’s parent company Mondelez recently announced that Oreo cookies, along with other products such as Sour Patch Kids and Ritz Crackers, will be increasing in price next year to account for costs incurred due to the supply chain crisis. Although they may not have announced it yet, no doubt the same will be true for many businesses in this category if these issues continue. In the months ahead, the impact of product shortages and price hikes will become clear: will young consumers purchase fewer snacks and treats, or make sacrifices in other areas of their spending?

Looking to the rest of Q4, holiday-themed products will be among the big sellers in food and drink, with many of the brands in this list launching festive items earlier every year. For example, M&Ms has launched their Holiday Mint special packs and vanilla ice cream Fun Cups with red and green candy. Meanwhile, the Christmas tree-shaped peanut butter snack is on shelves from Reese’s, along with various holiday-themed Kisses from Hershey’s, and of course the traditional gingerbread flavor Oreo cookies.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Oreo | 98% | 62% | 54% | 67% | 89 |

| 2 | Coca Cola | 98% | 63% | 56% | 58% | 83 |

| 3 | Doritos | 98% | 59% | 53% | 63% | 81 |

| 4 | M&M’s | 98% | 54% | 48% | 60% | 66 |

| 5 | Hershey’s | 97% | 54% | 47% | 60% | 58 |

| 6 | Lay’s | 95% | 57% | 52% | 58% | 56 |

| 7 | Pepsi | 99% | 47% | 40% | 47% | 45 |

| 8 | Reese’s | 96% | 50% | 45% | 57% | 40 |

| 9 | Ben & Jerry’s | 88% | 33% | 35% | 54% | 20 |

| 10 | Nestle | 93% | 31% | 28% | 40% | 13 |

Food & Drink

We polled over 1,000 young people to find out which food and drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

It’s good news for Coca-Cola as they move from joint first to sole first place, jumping ahead of Cadbury’s this quarter. Repositioning their brand as more sustainable could be a factor in growing their brand advocacy for 56% to 60%. The soft drinks company has historically been known as one of the corporations causing the most plastic waste, but they’re working hard to change that reputation, and recently announced the creation of their first bottle made from 100% plant-based sources, which they believe will be commercially scalable. Coca-Cola also has an ambitious goal to collect and recycle or reuse 100% of what they sell by 2030 and to be “net zero” by 2050.

However, not everything Coca-Cola has done this year has gone down well with the Gen Z demographic. A recent ad aimed at winning over the gaming community fell flat, despite featuring an array of top esports stars and involving a partnership with streaming platform Twitch. The ad was criticised for its lack of authenticity by gamers, who felt that it implied that they are isolated and need Coca-Cola to bring them together, an idea that didn’t ring true with those who find community and friendship through gaming.

Elsewhere in the top 10, Heinz is up from ninth to joint seventh place, while Galaxy slips from sixth to ninth. Looking ahead to next quarter’s rankings, we’ll be curious to see the impact of Christmas treats on the charts, with brands such as Cadbury’s and Oreo heavily promoting their festive products during this season.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Coca-Cola | 97% | 63% | 57% | 60% | 98 |

| 2 | Cadbury’s | 95% | 61% | 57% | 60% | 88 |

| 3 | Oreo | 97% | 48% | 43% | 56% | 70 |

| 4 | Pepsi | 95% | 54% | 47% | 49% | 65 |

| 5 | Walkers | 92% | 56% | 54% | 55% | 58 |

| 6 | Ben & Jerry’s | 93% | 43% | 40% | 56% | 44 |

| 7= | Heinz | 92% | 49% | 42% | 45% | 38 |

| 7= | Maltesers | 94% | 43% | 36% | 54% | 38 |

| 9 | Galaxy | 94% | 39% | 37% | 47% | 31 |

| 10 | Red Bull | 94% | 30% | 28% | 35% | 23 |

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Quarterly Commentary

Q4 2021

Welcome back to the quarterly Youth Brand Affinity Tracker from Student Beans, celebrating the brands that are resonating best and driving the most revenue from the 16-24 demographic across the US. In the following chapters you’ll learn which brands are on the rise with the valuable youth consumer and which are struggling, and we’ll share our analysis and predictions for the quarter ahead.

As we write this report, we’re in the midst of Q4, which marks the end of a calendar year that has seen brands and retailers strive to get their businesses back on track following the unprecedented challenges of 2020. Some have bounced back and are thriving with young consumers more than ever, while others are still figuring out what their proposition needs to look like as we enter the much talked about “new normal.”

We’re also poised to enter the biggest sales period of the year for brands in most of the categories we cover in this report: the holiday season. Kicking off with Black Friday and Cyber Monday, retail businesses are anticipating high demand as customers look to return to holiday shopping traditions. As a result, some retailers had already begun promoting their first round of Black Friday deals as early as October this year – more than a month before the big day in some cases.

However, Black Friday sales could be impacted this year by the issue currently top of mind for brands across every sector from food to travel: the supply chain crisis. A shortage of workers combined with a shortage of products could lead to a stressful holiday season for businesses and shoppers alike. Look out for our Q1 edition coming in early 2022, where we’ll look back on how brands fared and how these issues impacted brand engagement and advocacy among young consumers.

Methodology

Youth Affinity data is gathered every quarter, using the independent research panel provider Cint to reach a nationally representative panel of 1,000 young people aged 16-24, in line with US census data. The Q4 survey took place in October 2021.

For each sector, we provided our respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

In the tracker, you’ll find charts ranking the top 10 brands in each sector, based on their Youth Affinity Score. This score was generated by aggregating the results of each of the four metrics detailed above.

Quarterly Commentary

Q4 2021

Welcome back to the quarterly Youth Brand Affinity Tracker from Student Beans, celebrating the brands that are resonating best and driving the most revenue from the 16-24 demographic across the UK. In the following chapters you’ll learn which brands are on the rise with the valuable youth consumer and which are struggling, and we’ll share our analysis and predictions for the quarter ahead.

As we write this report, we’re in the midst of Q4, which marks the end of a calendar year that has seen brands and retailers strive to get their businesses back on track following the unprecedented challenges of 2020. Some have bounced back and are thriving with young consumers more than ever, while others are still figuring out what their proposition needs to look like as we enter the much talked about “new normal.”

We’re also poised to enter the biggest sales period of the year for brands in most of the categories we cover in this report: the festive season. Kicking off with Black Friday and Cyber Monday, retail businesses are anticipating high demand as customers look to return to holiday shopping traditions. As a result, some retailers had already begun promoting their first round of Black Friday deals as early as October this year – more than a month before the big day in some cases.

However, Black Friday sales could be impacted this year by the issue currently top of mind for brands across every sector from food to travel: the supply chain crisis. A shortage of workers combined with a shortage of products could lead to a stressful festive season for businesses and shoppers alike. Look out for our Q1 edition coming in early 2022, where we’ll look back on how brands fared and how these issues impacted brand engagement and advocacy among young consumers.

Methodology

Youth Affinity data is gathered every quarter, using the independent research panel provider Prodege to reach a nationally representative panel of 500 young people aged 16-24, in line with UK census data. The Q4 survey took place in October 2021.

For each sector, we provided our respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

In the tracker, you’ll find charts ranking the top 10 brands in each sector, based on their Youth Affinity Score. This score was generated by aggregating the results of each of the four metrics detailed above.