Youth brand affinity tracker

US Edition

UK Edition

Each quarter, we analyze the performance of leading brands in 10 of the sectors most important to Gen Z consumers.

To compile the Youth Brand Affinity Tracker, we look at four key metrics: Brand visibility, brand engagement, purchase intent & brand advocacy.

Fashion

We polled over 1,000 young people to find out which fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

This quarter, Old Navy overtakes Forever 21 to take the crown in the fashion category. Old Navy may not be the first brand you’d associate with the youth market due to its broad customer base, but it’s one that Gen Z has grown up with, so it commands a high level of trust and familiarity. It’s also affordable and accessible to shoppers across the country, with over 1,100 stores and an ecommerce site that attracts over 24 million monthly uniques. Another strength is its inclusive product range, catering to all shapes and sizes.

According to our data, Old Navy is one of the few fashion retailers with strong appeal to both male and female Gen Z customers. While a larger percentage of our male survey respondents were planning to shop there in the next three months, females were more likely to recommend the brand to their friends, and an almost exactly equal percentage of each gender had engaged with the brand in the past three months – visiting their stores, website or social media pages.

Other than Old Navy, the majority of brands in our list are more popular with females than males, with the exceptions of Old Navy’s parent company Gap and ecommerce brand Zappos, which both polled higher with males on all four of our metrics.

This sector is associated with male consumers, and that’s not inappropriate – males are more likely to have engaged with at least one of our 10 listed brands within the past three months. However, there are several brands in the chart that poll better with females than males, specifically Converse, Lululemon, and Vans. These are brands that even those who don’t enjoy sports often wear, considered just as suitable for class or a shopping trip as a gym session. They’re part of the typical look you’ll see across college campuses today, and their crossover appeal is key to their ubiquity.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Old Navy | 89% | 36% | 31% | 41% | 95 |

| =2 | Forever 21 | 84% | 36% | 32% | 40% | 88 |

| =2 | Victoria’s Secret | 87% | 33% | 30% | 43% | 88 |

| 4 | American Eagle | 81% | 27% | 27% | 38% | 65 |

| 5 | H&M | 76% | 30% | 27% | 37% | 60 |

| 6 | Shein | 53% | 27% | 25% | 30% | 45 |

| 7 | Gap | 80% | 23% | 20% | 26% | 40 |

| =8 | Fashion Nova | 67% | 21% | 20% | 28% | 30 |

| =8 | Urban Outfitters | 67% | 18% | 16% | 29% | 30 |

| 10 | Zappos | 35% | 9% | 8% | 13% | 10 |

Fashion – Retail

We polled over 500 young people to find out which in-store fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

As one of Gen Z’s most beloved brands across all sectors, it’s no surprise to see Nike at the top here. Despite gyms being closed and sports events cancelled, Nike’s sales have remained strong throughout the pandemic, as health-conscious consumers turn their attention to home fitness and solo activities such as running.

A recent survey of Student Beans users revealed that 89% want to improve their fitness in 2021. What better way to incentivise themselves to get back into a fitness routine than to splash out on some stylish yoga pants or a cool new pair of trainers?

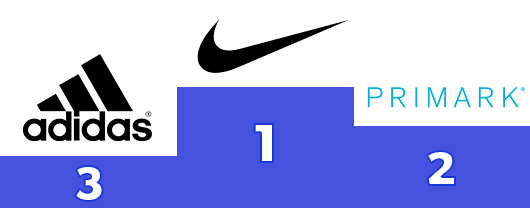

This quarter, Nike leapt ahead of our Q4 winner in this category, Primark. As one of the few remaining in-store-only fashion brands, the current lockdown means sales are not just reduced but non-existent for Primark in England, Scotland and Wales. While the retailer made the most of the festive season, opening some stores 24 hours a day in December, they have predicted lockdown will result in a £1bn loss. With store closures naturally impacting their brand engagement and purchase intent scores, we’re intrigued to see whether Primark will reclaim its crown once lockdown ends.

Elsewhere in the chart, it’s been a strong quarter for Adidas, which moved up from no.5 to no.3. The sportswear brand is particularly strong on the brand advocacy metric, perceived as both cool and good quality. Partnerships with superstars such as Beyoncé and Kanye West help Adidas to remain relevant and enable them to charge premium prices for their most sought-after, limited edition products, even though their customer base is relatively young. They provide a useful case study for brands who want their products to be front of mind when Gen Z consumers are ready to splash out on a special treat.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Nike | 96% | 52% | 46% | 57% | 93 |

| 2 | Primark | 95% | 53% | 47% | 52% | 90 |

| 3 | Adidas | 97% | 42% | 36% | 53% | 83 |

| 4 | JD Sports | 93% | 46% | 38% | 48% | 73 |

| 5 | H&M | 92% | 37% | 32% | 43% | 55 |

| 6 | Sports Direct | 94% | 32% | 27% | 38% | 50 |

| 7 | New Look | 88% | 35% | 27% | 39% | 43 |

| 8 | Topshop / Topman | 87% | 30% | 25% | 37% | 24 |

| 9 | Zara | 83% | 29% | 25% | 37% | 21 |

| 10 | Next | 92% | 28% | 21% | 34% | 20 |

Sports & Athleisure

We polled over 1,000 young people to find out which sports and athleisure brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

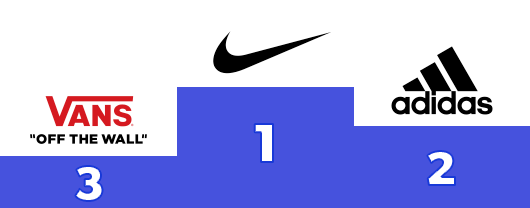

As one of Gen Z’s most beloved brands across all sectors, it’s no surprise to see Nike at the top here. Despite gyms being closed and sports events canceled, Nike’s sales have remained strong throughout the pandemic, as health-conscious consumers turn their attention to home fitness and solo activities such as running.

A recent survey of Student Beans users revealed that 89% want to improve their fitness in 2021. What better way to incentivize themselves to get back into a fitness routine than to splash out on some stylish yoga pants or a cool new pair of sneakers?

As a physical-first brand, Foot Locker’s presence in the top five is a positive sign for in-store retail in this sector, demonstrating that it is possible to remain relevant despite growing competition, and during a time when mall visits are down.

They have successfully innovated amid the rise of ecommerce and trends such as streetwear, hype culture, and resale apps. They smartly invested in resale platform GOAT in 2019, and have partnered with brands such as Adidas and Nike on exclusive product drops.

This sector is associated with male consumers, and that’s not inappropriate – males are more likely to have engaged with at least one of our 10 listed brands within the past three months. However, there are several brands in the chart that poll better with females than males, specifically Converse, Lululemon, and Vans. These are brands that even those who don’t enjoy sports often wear, considered just as suitable for class or a shopping trip as a gym session. They’re part of the typical look you’ll see across college campuses today, and their crossover appeal is key to their ubiquity.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Nike | 93% | 57% | 52% | 65% | 100 |

| 2 | Adidas | 91% | 41% | 35% | 49% | 88 |

| 3 | Vans | 87% | 38% | 36% | 48% | 83 |

| 4 | Converse | 84% | 29% | 26% | 39% | 66 |

| 5 | Foot Locker | 82% | 29% | 26% | 35% | 61 |

| 6 | Under Armour | 80% | 28% | 24% | 35% | 48 |

| 7 | Puma | 83% | 20% | 17% | 29% | 45 |

| 8 | Finish Line | 51% | 18% | 16% | 21% | 28 |

| 9 | Lululemon | 48% | 14% | 13% | 22% | 23 |

| 10 | StockX | 32% | 13% | 12% | 16% | 10 |

Fashion – Ecommerce

We polled over 500 young people to find out which online fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Retaining their place at the top in our ecommerce top 10, and placing first across all of our metrics, it has been a great quarter for ASOS. The 20-year-old business made the news recently when it purchased Topshop, the iconic retailer that has been a staple of British high streets since the 1960s. This reflects a changing of the guard as young consumers shift their fashion spending habits online, with lockdown losses unfortunately resulting in the closure of all of Topshop’s physical stores. However, a purchase by ASOS feels like a natural fit, as the ecommerce business has already stocked Topshop products for years, and as our research shows, has the attention of the new generation that Topshop sadly failed to engage.

In second place once again is Boohoo, another digital-first business that has demonstrated their power in the market and ambitious future plans by purchasing several struggling high street brands, including Dorothy Perkins and Burton.

As with ASOS’s Topshop and Miss Selfridge acquisition, Boohoo only wanted the brand names and their online businesses, declining to purchase the physical stores. This move not only pushes more spending online, but reshapes the fashion industry as in-store retail jobs decrease, while new opportunities emerge in the fast-growing ecommerce sector.

Close behind Boohoo is their sister brand, PrettyLittleThing, which performs particularly well considering they only stock women’s clothing. 55% of females have engaged with the brand in the past three months, higher than their sister brand, Boohoo. However, Boohoo is still slightly ahead with females in terms of purchase intent, with 44% planning to shop there, compared to 43% for PrettyLittleThing. Between these two brands and Nasty Gal, the Boohoo Group now owns three of the top 10 online fashion stores, making them an immensely powerful industry force.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | ASOS | 88% | 48% | 42% | 46% | 100 |

| 2 | Boohoo / Boohoo Man | 83% | 38% | 33% | 39% | 90 |

| 3 | Pretty Little Thing | 81% | 37% | 30% | 35% | 80 |

| 4 | Depop | 74% | 31% | 29% | 34% | 65 |

| 5 | Shein | 68% | 32% | 28% | 31% | 58 |

| 6 | Gymshark | 77% | 23% | 19% | 29% | 50 |

| 7 | Missguided | 73% | 25% | 22% | 27% | 48 |

| 8 | StockX | 40% | 17% | 16% | 20% | 25 |

| 9 | Nasty Gal | 56% | 15% | 15% | 19% | 23 |

| 10 | Zalando | 40% | 10% | 10% | 9% | 13 |

Retail

We polled over 1,000 young people to find out which retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Amazon is entering 2021 with news of a new CEO, as founder Jeff Bezos takes a step back, and with high expectations for the year ahead after a holiday season that outperformed all of the business’ sales records. Amazon took in $1.4 billion per day in Q4.

The home improvement sector also enjoyed a successful 2020, as spending more time at home inspired Americans to invest in DIY products. Home Depot and Lowe’s both benefited, with record-breaking annual sales. Our research shows that for Gen Z, Home Depot is outperforming its closest competitor across every metric, but with Lowe’s seeing faster growth in 2020 that could still change. For both brands, encouraging young consumers to try their hand at DIY will be key to winning over this market as they become home-owners.

Also in the home and living space, we see great affinity for Bed Bath and Beyond, who came second to Amazon on the important brand advocacy metric. This brand particularly appeals to females, 50% of whom would recommend it to a friend, compared to 30% of males. Young people may not be the top target market for larger furniture items, but their creative streak means they love to personalize their living space, so there’s plenty to excite them within Bed Bath & Beyond’s product range.

While the ecommerce and home and living brands within this list had a successful 2020, the department stores, which were already struggling pre-COVID, need to prove their relevance to younger consumers in order to survive. Businesses such as Macy’s, JCPenney and Kohls are under more pressure than ever to adapt to the needs of the digital native.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 94% | 70% | 68% | 68% | 100 |

| 2 | Home Depo | 89% | 34% | 27% | 38% | 83 |

| 3 | Bed Bath & Beyond | 84% | 28% | 28% | 40% | 75 |

| 4 | eBay | 90% | 31% | 26% | 33% | 70 |

| 5 | Macy’s | 88% | 27% | 21% | 33% | 58 |

| =6 | JCPenney | 87% | 24% | 20% | 33% | 45 |

| =6 | Kohls | 83% | 27% | 22% | 33% | 45 |

| 8 | IKEA | 81% | 21% | 20% | 36% | 38 |

| 9 | Lowe’s | 84% | 22% | 16% | 29% | 25 |

| 10 | Staples | 79% | 20% | 17% | 26% | 13 |

Retail

We polled over 500 young people to find out which of the retail superstores resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Amazon is entering 2021 with news of a new CEO, as founder Jeff Bezos takes a step back, and with high expectations for the year ahead after 2020 outperformed all of the business’ sales records. Amazon recently revealed that their UK sales grew by 51% last year – a staggering number considering they were already far ahead of any competitor. Amazon clearly benefited from a shift of spending from in-store to online during the pandemic, a fact proven particularly clearly when the ecommerce giant’s sales are compared to high street staple Marks & Spencer: UK customers spent twice as much at Amazon than they did at M&S last year.

While the ecommerce brands within this list had a successful 2020, the department stores, which were already struggling pre-COVID, need to prove their relevance to younger consumers in order to survive. Businesses such as M&S and John Lewis are under more pressure than ever to adapt to the needs of the digital native, as the spending power of Gen Z and Millennials increases and their custom becomes ever more crucial. The recent closure of all of Debenhams’ 124 physical stores after ecommerce business Boohoo chose to purchase only its online operation serves as a stark example of the fate they could face.

On a more positive note, both M&S and John Lewis, along with Argos, are among the brands who have strengthened their businesses by offering click and collect services. The option to collect online orders in-store while food shopping at M&S, Waitrose or Sainsbury’s enables these retailers to offer more competitive pricing by reducing delivery costs, and enables customers to collect purchases as their own convenience – both important factors impacting online purchasing decisions for Gen Z.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 96% | 76% | 66% | 69% | 100 |

| 2 | eBay | 94% | 55% | 45% | 50% | 85 |

| 3 | Argos | 94% | 48% | 34% | 51% | 79 |

| 4 | IKEA | 94% | 36% | 31% | 52% | 76 |

| 5 | M&S | 93% | 35% | 26% | 38% | 58 |

| 6 | Wilko | 85% | 33% | 28% | 38% | 48 |

| =7 | WHSmith | 90% | 26% | 22% | 36% | 35 |

| =7 | Etsy | 75% | 30% | 22% | 37% | 33 |

| 9 | John Lewis | 89% | 23% | 20% | 35% | 25 |

| 10 | Very | 79% | 19% | 14% | 21% | 13 |

Grocery

We polled over 1,000 young people to find out which grocery brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Once again, it’s a tale of two giants in the grocery sector this quarter. Walmart leads the top 10 with Target close behind. We also saw strong results for 7-Eleven and CostCo, significantly ahead of any other rivals according to our proprietary metric, the Youth Affinity Score. It’s good news for Costo in particular, jumping ahead of Kroger to earn a place in the top four, no doubt benefiting from the bulk buying trend, that has been strengthened by the need to reduce grocery store trips during the pandemic.

Walmart and Target have also remained strong during the pandemic, thanks to their wide product range. Despite their lower risk of serious illness, young people are anxious about catching the virus and potentially spreading it to their family or the wider community. Currently, customers prefer to visit one store where they can buy everything they need rather than shop around and take unnecessary risks. Grocery chains have strengthened their relationships with customers by supporting them through the difficult past year, and they will continue to play an important role as the COVID-19 vaccine is rolled out. In February, Walmart began administering vaccines on-site at stores around the country.

Ecommerce growth is also high priority for Walmart and Target as they tackle 2021. In a recent earnings call, Target’s CEO stated that same-day delivery and pick-up options have been key to driving more digital sales. They reported a 105% year-on-year increase in ecommerce earnings. For Walmart, ambitious investments in its attempt to compete with Amazon mean their ecommerce division is operating at a loss, but sales are growing and their new Walmart+ membership product is one to watch in the year ahead.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Walmart | 93% | 70% | 67% | 61% | 100 |

| 2 | Target | 92% | 58% | 56% | 58% | 90 |

| 3 | 7-Eleven | 87% | 36% | 33% | 34% | 78 |

| 4 | Costco | 79% | 30% | 28% | 35% | 73 |

| 5 | Aldi | 63% | 25% | 24% | 28% | 48 |

| =6 | Trader Joe’s | 66% | 22% | 20% | 29% | 45 |

| =6 | Whole Foods Market | 71% | 23% | 19% | 28% | 45 |

| 8 | Kroger | 63% | 23% | 23% | 25% | 43 |

| 9 | Safeway | 45% | 15% | 15% | 15% | 19 |

| 10 | Instacart | 45% | 15% | 13% | 15% | 11 |

Supermarkets

We polled over 500 young people to find out which supermarket brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

This quarter, we see little change at the top as the “big three” supermarkets retain their positions. However, it’s remarkable how little difference there is between the Youth Affinity Scores of Sainsbury’s and the budget supermarket chains Aldi and Lidl. In fact, both challenger brands outperformed Sainsbury’s on the brand advocacy metric, suggesting young consumers would prefer to shop there if they could. As Aldi and Lidl open more stores and grow their presence around the UK, they are likely to overtake within 2021.

A recent Which? report found Lidl and Aldi were the UK’s cheapest supermarkets with an average basket containing 19 essential grocery products costing £18.45. ASDA followed behind, with our winner Tesco in fourth place. Tesco’s strong position in our chart shows that cost is not the only factor determining purchasing decisions. Previous Student Beans research found that 16-24s who said Tesco was the grocery store they were most likely to shop at cited its quality and variety as the reasons behind their choice, as well as price. Plus, with close to 4,000 stores nationwide, it’s way ahead of the rest of the top five in terms of accessibility – only Co-op (no.6) has more stores.

Tesco has also been adapting their offering to better serve the needs and interests of younger consumers, for example widening their range of vegan food and alcohol-free drinks. Interest in these products soared during January 2021, driven by a larger number of people making Dry January and Veganuary pledges. The retailer revealed that demand for low and no alcohol spirits grew by over 50%, while sales of low and no wines increased by 40%, and sales of plant-based foods were 35% higher than they were in January 2020.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Tesco | 95% | 68% | 62% | 60% | 93 |

| 2 | ASDA | 96% | 64% | 56% | 57% | 89 |

| 3 | Sainsbury’s | 96% | 52% | 43% | 46% | 74 |

| 4 | Aldi | 94% | 52% | 47% | 51% | 73 |

| 5 | Lidl | 96% | 46% | 41% | 47% | 70 |

| 6 | Co-op | 91% | 47% | 40% | 39% | 45 |

| 7 | Iceland | 93% | 40% | 32% | 41% | 39 |

| 8 | Morrison’s | 93% | 40% | 34% | 36% | 39 |

| 9 | Waitrose | 85% | 21% | 19% | 28% | 18 |

| 10 | Spar | 75% | 18% | 20% | 20% | 13 |

Entertainment

We polled over 1,000 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

In a closely run race, YouTube beats Netflix on brand engagement and visibility, while Netflix wins on purchase intent. While the stereotype of Gen Z is that they’re constantly on Instagram and TikTok, our research consistently shows that YouTube has a larger audience within this demographic.

Our 2020 Student Shopping Report revealed that 84% of US 16-24s use YouTube at least once a month. This means it’s not only a powerful marketing tool for brands, but it’s also a contender in the VOD space. It’s rarely mentioned in the same breath as Netflix, Disney+, and Hulu, but YouTube’s premium video and music service passed 20 million subscribers in 2020, and the brand’s place in the hearts of Gen Z means it shouldn’t be underestimated.

Also within the streaming sector, we see Disney+ overtake Hulu this quarter, an impressive achievement for a service that only launched at the end of 2019. Recent successes have included the new Marvel series, WandaVision, and there are more big releases to come in 2021, such as Loki (another Marvel show) and Star Wars spin-off The Book of Boba Fett. According to our survey, Disney+’s popularity skews younger than its competitors, so winning over the older segment of Gen Z will be a task for the year ahead.

Gaming remains a key category within entertainment, and particularly with the male demographic. Each of the gaming brands in our list scored significantly higher with males than females. We also can’t fail to mention GameStop within this sector, a business that has had a remarkable start to 2021. While our survey took place ahead of their stock market rush, we’ll be intrigued to see how that news impacts their Youth Affinity Score next quarter.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | YouTube | 95% | 76% | 41% | 67% | 98 |

| 2 | Netflix | 94% | 72% | 54% | 67% | 93 |

| 3 | Spotify | 92% | 53% | 36% | 52% | 73 |

| 4 | Disney+ | 91% | 50% | 37% | 53% | 70 |

| 5 | Hulu | 90% | 50% | 37% | 50% | 68 |

| 6 | Playstation | 90% | 39% | 30% | 44% | 50 |

| 7 | Nintendo | 89% | 35% | 25% | 39% | 33 |

| 8 | GameStop | 89% | 30% | 25% | 35% | 30 |

| 9 | Apple Music | 87% | 33% | 26% | 33% | 28 |

| 10 | Steam | 55% | 22% | 19% | 27% | 10 |

Entertainment

We polled over 500 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

In a closely run race, YouTube beats Netflix on brand engagement, while Netflix wins on purchase intent and brand advocacy, therefore taking the top spot overall. The combination of lockdown and a cold, snowy winter means Brits have been binge-watching Netflix more than ever, generating huge recent hits such as Bridgerton and The Queen’s Gambit. The new film in the teen series To All The Boys I’ve Loved Before has also been a big winner with Gen Z viewers.

While the stereotype of Gen Z is that they’re constantly on Instagram and TikTok, our research consistently shows that YouTube has a larger audience within this demographic. Our latest Student Shopping Report reveals that 82% of UK 16-24s use YouTube at least once a month. This means it’s not only a powerful marketing tool for brands, but it’s also a contender in the VOD space. It’s rarely mentioned in the same breath as Netflix, Disney+ and Now TV, but YouTube’s premium video and music service passed 20 million subscribers in 2020, and the brand’s place in the hearts of Gen Z means it shouldn’t be underestimated.

Gaming remains a key category within entertainment, with 54% of students stating that they’ve spent more time playing console or computer games during the pandemic, while 52% have spent more time on mobile games. The new Playstation 5 and Xbox Series X/S were at the top of many young people’s 2020 Christmas wishlists, and are still tough to get hold of even months after their November release.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Netflix | 97% | 76% | 59% | 70% | 98 |

| 2 | YouTube | 96% | 78% | 40% | 67% | 90 |

| 3 | Spotify | 96% | 64% | 48% | 61% | 83 |

| 4 | Disney+ | 93% | 47% | 34% | 48% | 64 |

| 5 | Playstation | 95% | 38% | 27% | 42% | 60 |

| 6 | Xbox | 94% | 38% | 24% | 38% | 55 |

| 7 | Nintendo | 93% | 29% | 20% | 36% | 36 |

| 8 | Apple Music | 91% | 31% | 23% | 31% | 35 |

| 9 | Now TV | 86% | 25% | 19% | 26% | 16 |

| 10 | Game | 82% | 21% | 19% | 29% | 14 |

Travel

We polled over 1,000 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

While older generations may still be getting accustomed to the idea of the sharing economy, our survey results prove that Gen Z is entirely comfortable with the concept. For the second quarter in a row, Uber, Lyft, and Airbnb take the top three spots in our travel top 10. Gaining consumer trust is the biggest challenge for these brands, but they’ve clearly achieved that as all three ranked highly for brand advocacy, demonstrating that young people are happy to recommend them to a friend.

How brands have responded to the coronavirus pandemic has become an important factor in how they are perceived by Gen Z. At the end of 2020, Uber published some impressive stats summing up the ways they’ve given back to the communities where they operate. This has included providing 10 million free rides and deliveries of food to healthcare workers, seniors, and others in need, as part of their Move What Matters campaign. They also took action to protect their workers, allocating $50 million to purchase health and safety supplies for drivers and delivery people around the world.

It’s no surprise that brand engagement and purchase intent increases with age in the travel sector, as young people become more independent as they head to college and join the workforce. Our 2020 Student Shopping Report revealed that, prior to the pandemic, 84% of college students took at least one vacation per year, and we can confidently expect them to resume that behavior in the future.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 89% | 36% | 42% | 47% | 100 |

| 2 | Lyft | 79% | 25% | 23% | 34% | 90 |

| 3 | Airbnb | 71% | 20% | 18% | 30% | 11 |

| 4 | United Airlines | 74% | 16% | 15% | 22% | 73 |

| 5 | American Airlines | 78% | 15% | 14% | 24% | 65 |

| 6 | Delta | 73% | 14% | 14% | 24% | 64 |

| 7 | Southwest Airlines | 64% | 14% | 14% | 12% | 56 |

| 8 | TripAdvisor | 66% | 12% | 10% | 18% | 40 |

| 9 | Booking.com | 50% | 11% | 11% | 16% | 30 |

| 10 | Expedia | 57% | 10% | 10% | 16% | 19 |

Travel

We polled over 500 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

While older generations may still be getting accustomed to the idea of the sharing economy, our survey results prove that Gen Z is entirely comfortable with the concept. For the second quarter in a row, Uber takes the top spot in our travel top 10. Gaining consumer trust is the biggest challenge for Uber, along with other sharing economy businesses such as Airbnb, but they’ve clearly achieved that as they ranked higher than any other travel brand for brand advocacy, demonstrating that young people are happy to recommend them to a friend.

How brands have responded to the coronavirus pandemic has become an important factor in how they are perceived by Gen Z. At the end of 2020, Uber published some impressive stats summing up the ways they’ve given back to the communities where they operate. This has included providing 10 million free rides and deliveries of food to healthcare workers, seniors, and others in need, as part of their Move What Matters campaign. They also took action to protect their workers, allocating $50 million to purchase health and safety supplies for drivers and delivery people around the world.

We were unsurprised to discover that brand engagement and purchase intent increases with age across the travel sector, as young people become more independent as they head to university and join the workforce. Our brand new UK Student Shopping Report reveals that, prior to the pandemic, 90% of university students took at least one holiday per year, and we can confidently expect them to resume that behaviour in the future.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 95% | 39% | 42% | 42% | 100 |

| 2 | Premier Inn | 90% | 25% | 21% | 37% | 83 |

| 3 | Booking.com | 76% | 28% | 24% | 34% | 73 |

| 4 | EasyJet | 88% | 22% | 19% | 32% | 68 |

| 5 | British Airways | 90% | 22% | 17% | 37% | 66 |

| 6 | Airbnb | 75% | 19% | 18% | 31% | 46 |

| 7 | Travelodge | 85% | 19% | 17% | 30% | 41 |

| 8 | National Express | 73% | 19% | 17% | 25% | 36 |

| 9 | RyanAir | 83% | 16% | 13% | 19% | 23 |

| 10 | TUI | 69% | 14% | 13% | 24% | 15 |

Health & Beauty

We polled over 1,000 young people to find out which health and beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s no change at the top in this health and beauty category, with nationwide chains Walgreens and CVS remaining strong. The two leading pharmacies have been relied upon throughout the pandemic for essential products, and now they’re playing an even more important role as some of the main providers of the COVID vaccine. Walgreens is primarily known for its physical stores, but they are adapting both to the digital era and the current situation by offering a new pickup service and partnering with DoorDash and Postmates to improve their delivery options.

Within the beauty sector, we see multi-brand retailers Ulta and Sephora in the lead across all metrics. In light of the Black Lives Matter movement, Ulta made a strong statement in February when they announced actress Tracee Ellis Ross as Diversity and Inclusion Advisor, as well as committing to double the number of Black-owned brands they sell and feature more Black women in their ads. This is a great example of a business responding to the movement with proactive changes, not simply statements of support, and it’s sure to impress their politically-minded Gen Z customers.

Also within beauty, it’s great to see Student Beans partner e.l.f Cosmetics placing above MAC, an impressive achievement for a brand that was formed 20 years later than its rival. While MAC is an aspirational brand loved by Millennials, e.l.f clearly resonates more with Gen Z. Their products are more affordable, but the brand still places importance on quality and ethics, with a commitment to selling only vegan and cruelty-free items.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Walgreens | 89% | 46% | 42% | 42% | 98 |

| 2 | CVS | 87% | 45% | 40% | 40% | 88 |

| 3 | Bath & Body Works | 86% | 42% | 37% | 37% | 85 |

| 4 | Ulta Beauty | 70% | 28% | 25% | 25% | 68 |

| 5 | Sephora | 72% | 25% | 22% | 22% | 63 |

| 6 | L’Oreal | 68% | 21% | 17% | 17% | 48 |

| 7 | E.L.F. Cosmetics | 52% | 20% | 18% | 18% | 39 |

| 8 | MAC | 57% | 14% | 14% | 14% | 25 |

| 9 | Rite Aid | 52% | 16% | 15% | 15% | 24 |

| 10 | Lush | 48% | 12% | 12% | 12% | 15 |

Health & Beauty

We polled over 500 young people to find out which health and beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s no movement at the top in this category this quarter, with high street staples Boots and Superdrug standing strong. Their wide range of products makes them a one-stop shop for healthcare, cosmetics and much more, and they both offer a student discount, appealing to young shoppers who value convenience and price when making purchasing decisions.

Elsewhere in our top five, it’s no surprise to see two brands known for their ethical products and policies: The Body Shop and Lush. Our research has consistently shown that health and beauty is the sector where young people are most influenced by brand ethics, preferring to buy cruelty-free and vegan products wherever possible.

The brand advocacy score for Lush is particularly notable as it’s significantly higher than would be expected based on their scores on our other metrics, showing this is a brand young people really love. Just missing the top five is another brand that appeals to Gen Z’s ethics and health-conscious attitude, Holland & Barrett.

Health and beauty is a sector where our results show a distinct gender disparity that is worth noting. Brand engagement is significantly higher with females for all brands in our list except for shaving brand Gillette and the two fitness brands, MyProtein and Pure Gym, each of which males were much more likely to have engaged with in the past three months. Meanwhile, if viewing the results for females alone, Beauty Bay would rank in the top five for brand engagement, purchase intent and brand advocacy, demonstrating that the online cosmetics retailer is one to watch.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Boots | 94% | 55% | 48% | 53% | 100 |

| 2 | Superdrug | 91% | 51% | 43% | 50% | 90 |

| 3 | The Body Shop | 85% | 29% | 26% | 40% | 80 |

| 4 | Gillette | 80% | 24% | 25% | 31% | 65 |

| 5 | Lush | 78% | 27% | 24% | 39% | 65 |

| 6 | Holland & Barrett | 77% | 22% | 18% | 30% | 43 |

| 7 | Beauty Bay | 56% | 23% | 19% | 28% | 40 |

| 8 | MAC | 74% | 20% | 16% | 27% | 30 |

| 9 | Pure Gym | 69% | 18% | 18% | 26% | 28 |

| 10 | MyProtein | 51% | 17% | 15% | 23% | 10 |

Restaurants & Takeout

We polled over 1,000 young people to find out which restaurants and takeout brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

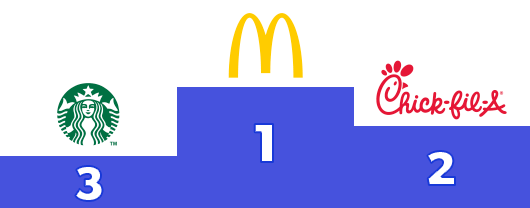

The past year has been tough for the restaurant industry, but McDonald’s continues to thrive. While restaurants are closing around the country, a recent McDonald’s earnings call revealed they plan to open 500 new locations around the US this year and 1300 worldwide. They have weathered the pandemic thanks to their takeout, drive-thru, and delivery options, putting them ahead of the game when other restaurants were forced to adapt to changed customer needs with little notice.

McDonald’s is also one of several restaurant chains that demonstrated their commitment to growing their Gen Z customer base in recent months by partnering with one of the younger generation’s favorite celebrities. Their partnership with rapper Travis Scott is one example of the trend, where customers can order a meal featuring the exact combination of items the celebrity likes to order from the restaurant themselves. Similarly, Dunkin’ Donuts customers can now try out Charli D’Amelio’s favorite caramel cold brew, while Shawn Mendes fans can enjoy the salad bowl he orders when he visits Chipotle.

While McDonald’s is our overall winner, it’s interesting to see that 16-24s are more likely to recommend Chick-Fil-A and Starbucks to their friends. This suggests that while McDonald’s plays a bigger role in their daily lives, they feel more positively towards the other two brands’ products, perceiving them as higher quality. In previous surveys, we’ve seen fans of Chick-Fil-A describe it as “delicious” and “amazing,” while McDonald’s fans were more likely to praise its prices.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 94% | 64% | 57% | 50% | 95 |

| 2 | Chick-Fil-A | 92% | 51% | 50% | 56% | 85 |

| 3 | Starbucks | 91% | 49% | 46% | 52% | 69 |

| 4 | Wendy’s | 92% | 42% | 40% | 46% | 63 |

| 5 | Taco Bell | 91% | 45% | 40% | 42% | 51 |

| =6 | Dunkin’ Donuts | 91% | 39% | 37% | 46% | 50 |

| =6 | Subway | 91% | 42% | 38% | 45% | 50 |

| 8 | Burger King | 93% | 39% | 36% | 39% | 40 |

| 9 | Pizza Hut | 92% | 36% | 32% | 40% | 30 |

| 10 | Chipotle | 87% | 35% | 33% | 42% | 18 |

Restaurants & Takeaway

We polled over 500 young people to find out which restaurant and takeaway brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

The past year has been tough for the restaurant industry, but McDonald’s continues to thrive. While restaurants are closing around the country, a recent McDonald’s earnings call revealed they plan to open 1300 new locations around the world this year. They have weathered the pandemic thanks to their pre-existing takeaway, drive-thru, and delivery options, putting them ahead of the game when other restaurants were forced to adapt to changed customer needs with little notice.

Restaurant chains are in a stronger position during the current UK lockdown compared to the first lockdown last spring, as restrictions are less stringent, with takeaways allowed as well as delivery. They’re also much more prepared, which means this time they can take advantage of the fact that takeaway meals are one of the few treats accessible to consumers at this time – a luxury that most people are spending more than ever on during the pandemic.

The rise of food delivery apps has also encouraged this trend. As of January 2021, 63% of 16-24s had ordered from a restaurant online, and 31% of those had done so for the first time during the pandemic.

Nando’s and Wagamama, the brands on our list that would normally depend on customers enjoying a sit-down meal within the restaurant, are relying on revenue from delivery and collection to survive. This means using their marketing channels and budget to raise awareness of their delivery offering, as well as strengthening their relationships with their target audience to ensure they’ll be excited to return to eating in post-pandemic. For Nando’s, recent initiatives include sharing celebrities’ Nando’s orders, and releasing their own Instagram sticker collection.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 96% | 74% | 66% | 65% | 90 |

| 2 | KFC | 96% | 57% | 51% | 56% | 86 |

| 3 | Domino’s | 96% | 49% | 47% | 50% | 74 |

| 4 | Greggs | 94% | 50% | 43% | 55% | 63 |

| 5 | Costa Coffee | 96% | 45% | 40% | 51% | 59 |

| 6 | Subway | 95% | 45% | 43% | 50% | 55 |

| 7 | Starbucks | 96% | 41% | 36% | 46% | 46 |

| 8 | Nando’s | 95% | 39% | 38% | 54% | 45 |

| 9 | Krispy Kreme | 87% | 24% | 25% | 48% | 23 |

| 10 | Wagamama | 75% | 19% | 20% | 35% | 10 |

Tech & Mobile

We polled over 1,000 young people to find out which tech & mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

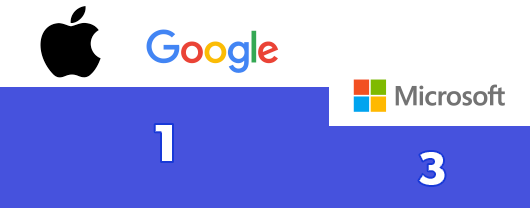

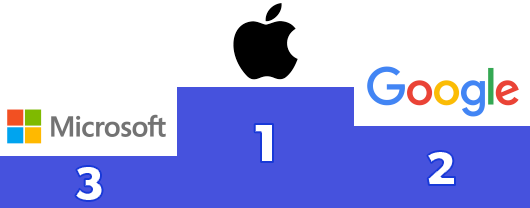

This quarter, our previous tech and mobile winner Apple shares the top spot with Google. Both brands reached impressive milestones in 2020, with Apple receiving a historic $2 trillion valuation, and Google passing the $1 trillion mark. Microsoft is the only other tech company in the trillionaires club, but our data shows that Gen Z doesn’t rate it as highly, and is much less likely to recommend it to their friends – an issue Microsoft will need to overcome to achieve longevity with the next generation of consumers and business leaders. Microsoft’s ties to the gaming community, thanks to the Xbox, should be key to its Gen Z growth strategy.

Tech and mobile is one of the sectors where young people tell us they prefer to shop online rather than in-person, so it’s promising to see Best Buy standing strong in our top five. For more expensive purchases, many young consumers say they like to see the product in person. They take these bigger investments seriously, wanting to ensure they get good value for money and make a fully informed purchasing decision.

Among the wireless providers on our list, Verizon is a clear winner. Fans of the brand praised its reliable service and unlimited data. In a 2020 survey of Student Beans users, we learned that their priorities when choosing a network are the cost and cell coverage, followed by the texts, talk time, and data included in the package. 30% of our US users are currently with Verizon, while 28% are with T-Mobile/Sprint, and 25% AT&T.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| =1 | Apple | 94% | 60% | 46% | 60% | 95 |

| =1 | 94% | 62% | 35% | 54% | 95 | |

| 3 | Microsoft | 92% | 37% | 25% | 37% | 75 |

| 4 | Best Buy | 91% | 34% | 29% | 39% | 74 |

| 5 | Samsung | 91% | 32% | 20% | 34% | 55 |

| 6 | Verizon | 90% | 30% | 20% | 32% | 53 |

| 7 | AT&T | 90% | 30% | 20% | 29% | 40 |

| 8 | T-mobile | 89% | 30% | 20% | 28% | 31 |

| 9 | Sony | 88% | 23% | 16% | 28% | 20 |

| 10 | Xfinity | 73% | 22% | 16% | 25% | 13 |

Tech & Mobile

We polled over 500 young people to find out which tech and mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

This quarter, our previous tech and mobile winner Apple retains the top spot, but Google is close behind, rising from no.4 to no.2. Both brands reached impressive milestones in 2020, with Apple receiving a historic $2 trillion valuation, and Google passing the $1 trillion mark.

Microsoft is the only other tech company in the trillionaires club, but our data shows that Gen Z don’t rate it as highly, and is much less likely to recommend it to their friends – an issue Microsoft will need to overcome to achieve longevity with the next generation of consumers and business leaders. Microsoft’s ties to the gaming community, thanks to the Xbox, should be key to its Gen Z growth strategy.

Tech and mobile is one of the sectors where young people tell us they prefer to shop online rather than in-person, so it’s promising to see Currys PC World standing strong in our top five. For more expensive purchases, many young consumers say they like to see the product in person. They take these bigger investments seriously, wanting to ensure they get good value for money and make a fully informed purchasing decision.

Currys PC World’s continued popularity, even during the national lockdown, shows their established, trusted brand name has helped them pick up a large portion of online tech spending, even while competing with the might of Amazon. In previous Gen Z research, we’ve found that young shoppers are more likely to trust an online store if they recognise the brand from their physical outlets. We’ll be intrigued to see whether Currys and the other in-store brand in our list, Carphone Warehouse, see a boost in our Q2 survey if physical stores are allowed to open by that time.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Apple | 95% | 59% | 42% | 62% | 95 |

| 2 | 97% | 56% | 27% | 51% | 93 | |

| 3 | Microsoft | 96% | 43% | 23% | 40% | 75 |

| 4 | Currys PC World | 94% | 34% | 26% | 40% | 70 |

| 5 | Sky | 93% | 40% | 23% | 35% | 63 |

| 6 | Samsung | 94% | 27% | 18% | 35% | 55 |

| 7 | O2 | 93% | 23% | 18% | 29% | 33 |

| 8 | BT | 92% | 26% | 17% | 30% | 30 |

| 9 | EE | 92% | 26% | 18% | 29% | 28 |

| 10 | Carphone Warehouse | 88% | 13% | 13% | 21% | 10 |

Food & Drink

We polled over 1,000 young people to find out which food and drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

For the second quarter in a row, it was close at the top in this category, but Doritos has overtaken Coca-Cola to take the prize. Doritos are currently running a major advertising campaign for their new 3D Crunch product range, including a star-studded Super Bowl ad featuring Matthew McConaughey, Jimmy Kimmel, and Mindy Kaling, directed by La La Land creator Damien Chazelle.

Coca-Cola might not be the first brand you’d expect to be affected by the pandemic (you can still drink Coke at home, of course) but in fact, the business has had a tough year, as it relies more on out-of-home consumption than competitors such as Pepsi. However, as our research confirms, love for the product remains strong, so we can confidently expect revenues to bounce back as COVID restrictions are lifted. New products now available in grocery stores, such as the intriguing Coca-Cola with Coffee, could also help turn the business’ fortunes around in 2021.

We should also highlight the popularity of Oreo, which may have placed third overall, but came out top in the brand advocacy metric, showing a real affection for the product and brand among Gen Z. Oreo is known for its endless array of new flavors, from birthday cake to chocolate peanut butter pie, but it’s the classic original that remains a staple snack, selling twice as many as the second most popular version, the Double Stuf. However, Oreo’s current partnership with Lady Gaga on the bright pink Chromatica Oreo is sure to be remembered as a cult favorite.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Walmart | 93% | 70% | 67% | 61% | 100 |

| 2 | Target | 92% | 58% | 56% | 58% | 90 |

| 3 | 7-Eleven | 87% | 36% | 33% | 34% | 78 |

| 4 | Costco | 79% | 30% | 28% | 35% | 73 |

| 5 | Aldi | 63% | 25% | 24% | 28% | 48 |

| =6 | Trader Joe’s | 66% | 22% | 20% | 29% | 45 |

| =6 | Whole Foods Market | 71% | 23% | 19% | 28% | 45 |

| 8 | Kroger | 63% | 23% | 23% | 25% | 43 |

| 9 | Safeway | 45% | 15% | 15% | 15% | 19 |

| 10 | Instacart | 45% | 15% | 13% | 15% | 11 |

Food & Drink

We polled over 500 young people to find out which food and drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Coca-Cola might not be the first brand you’d expect to be affected by the pandemic (you can still drink Coke at home, of course) but in fact, the business has had a tough year, as it relies more on out-of-home consumption than competitors such as Pepsi. However, as our research confirms, love for the product remains strong, so we can confidently expect revenues to bounce back as COVID restrictions are lifted.

We should also highlight the popularity of Cadbury’s, which may have placed second overall, but came out top in the brand advocacy metric, showing a real affection for the brand and their products among Gen Z. As a classic British brand that they’ve been enjoying since childhood, Cadbury’s has a comfort factor which makes it even more appealing during the stresses of the pandemic. They’ve also helped to make the weekly shop (the only weekly outing for many during lockdown) more fun by releasing new products to try, such as the Orange Twirl, initially limited edition but now widely available after social media hype turned into huge demand.

Another classic British brand, Walkers takes third place, rising from seventh last quarter. Remaining relevant is a challenge for a brand founded over 70 years ago, but they’ve taken a creative approach to achieving this, by forming partnerships with a range of restaurant brands beloved by young consumers. They recently launched a new Kentucky Fried Chicken flavour in collaboration with KFC, promoted with an advert featuring Gary Lineker dressed as the Colonel. This follows similar partnerships with Nando’s and Pizza Express, where they released crisps inspired by those restaurants’ most popular dishes.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Coca Cola | 96% | 66% | 60% | 61% | 94 |

| 2 | Cadbury’s | 92% | 67% | 60% | 63% | 80 |

| 3 | Walkers | 94% | 60% | 52% | 57% | 71 |

| 4 | Oreo | 96% | 53% | 47% | 55% | 60 |

| 5 | Pepsi | 96% | 52% | 48% | 53% | 59 |

| 6 | Galaxy | 96% | 53% | 45% | 54% | 53 |

| 7 | Ben & Jerry’s | 93% | 43% | 45% | 60% | 40 |

| 8 | Maltesers | 92% | 52% | 46% | 56% | 40 |

| 9 | Heinz | 90% | 51% | 49% | 45% | 33 |

| 10 | Red Bull | 94% | 36% | 34% | 40% | 21 |

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Quarterly Commentary

Q1 2021

In our first Youth Brand Affinity Index of 2021, we’re looking ahead at a year filled as much with uncertainty as with hope. For brands, it’s a time to be grateful for the glimpses of a return to normality, but also to reflect on which of the changes made in light of COVID-19 they might want to take with them into a post-pandemic future. This year, we’ll start to find out which industries will return straight back to their old ways, and which have been transformed forever.

The start of a new year brings new positivity, and after putting their plans on hold for much of 2020, Gen Z are excited to progress with their life goals and experience new things in 2021. Many are predicting that this year will see enthusiasm among young people to make up for the time they lost. This could include celebrating their renewed freedom by splashing out on purchases they couldn’t make while quarantining – a phenomenon that has been described as “revenge spending.” It has been suggested that this summer will mark the start of another Roaring Twenties in America, mirroring the era of mass consumerism and cultural experimentation that followed the First World War.

However, before we reach that promised era of positivity, it’s important for brands to remember that Gen Z is still experiencing a time of stress and anxiety. The year began with some of the most disturbing political events of their lifetime, and we mustn’t declare the pandemic over quite yet, even though vaccine rollout has begun. After all, as of February we are still seeing around 3000 deaths per day caused by the virus. The time to offer support and sensitivity to young consumers hasn’t ended, and how your brand handles the situation will be remembered.

Within this interactive tracker, we’ve highlighted the brands that are thriving as we enter 2021, those who have responded impressively to unprecedented circumstances and delivered what the 16-24 demographic is looking for. Compared to the previous quarter, we’ve seen brands rise and fall in every sector, with some surprising changes emerging in our data. Read on to find out which brands are winning with Gen Z, and which will need to adapt quickly to remain relevant to younger shoppers with more choice than ever before.

Methodology

Youth Affinity data is gathered every quarter, using the independent research panel provider Cint to reach a nationally representative panel of over 1,000 young people aged 16-24, in line with US census data. The Q1 survey took place in January 2021.

For each sector, we provided respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

These four metrics were combined to calculate a Youth Affinity Score for each brand, which we have used to create a ranking of the top 10 in each sector.

Quarterly Commentary

Q1 2021

In our first Youth Brand Affinity Index of 2021, we’re looking ahead at a year filled as much with uncertainty as with hope. For brands, it’s a time to be grateful for the glimpses of a return to normality, but also to reflect on which of the changes made in light of COVID-19 they might want to take with them into a post-pandemic future. This year, we’ll start to find out which industries will return straight back to their old ways, and which have been transformed forever.

The start of a new year brings new positivity, and after putting their plans on hold for much of 2020, Gen Z are excited to progress with their life goals and experience new things in 2021. Many are predicting that this year will see enthusiasm among young people to make up for the time they lost. This could include celebrating their renewed freedom by splashing out on purchases they couldn’t make while quarantining – a phenomenon that has been described as “revenge spending.” It has been suggested that this summer will mark the start of another Roaring Twenties, mirroring the era of mass consumerism and cultural experimentation that followed the First World War.

However, before we reach that promised era of positivity, it’s important for brands to remember that Gen Z is still experiencing a time of stress and anxiety. We mustn’t declare the pandemic over quite yet, even though vaccine rollout has begun. After all, as of February we are still seeing around 900 deaths per day caused by the virus in the UK. The time to offer support and sensitivity to young consumers hasn’t ended, and how your brand handles the situation will be remembered.

Within this tracker, we’ve highlighted the brands that are thriving as we enter 2021, those who have responded impressively to unprecedented circumstances and delivered what the 16-24 demographic is looking for. Compared to the previous quarter, we’ve seen brands rise and fall in every sector, with some surprising changes emerging in our data. Read on to find out which brands are winning with Gen Z, and which will need to adapt quickly to remain relevant to younger shoppers with more choice than ever before.

Methodology

Youth Affinity data is gathered every quarter, using the independent research panel provider Cint to reach a nationally representative panel of over 500 young people aged 16-24, in line with UK census data. The Q1 survey took place in January 2021.

For each sector, we provided our respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

These four metrics were combined to calculate a Youth Affinity Score for each brand, which we have used to create a ranking of the top 10 in each sector.