Youth brand affinity tracker

US Edition

UK Edition

Each quarter, we analyze the performance of leading brands in 10 of the sectors most important to Gen Z consumers.

To compile the Youth Brand Affinity Tracker, we look at four key metrics: Brand visibility, brand engagement, purchase intent & brand advocacy.

Fashion

We polled over 1,000 young people to find out which fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Old Navy stands firm in first place in our fashion top ten, and even managed to significantly increase their scores for brand engagement (up by 7%) and purchase intent (up by 5%) compared to last quarter. Old Navy isn’t afraid to stand up for its company values of diversity and inclusion, even if some customers may complain. The brand not only caters to a wide range of body shapes (and makes this clear in their advertising), but they also support same-sex relationships and interracial couples by featuring them on their social media. Recently they released a range of t-shirts designed by black artists to celebrate Black History Month, as part of their Project WE initiative.

Old Navy’s parent company is also on the up. Gap overtook Urban Outfitters, thanks to an increase in scores for brand engagement, purchase intent and brand advocacy. This may come as a surprise to those who had written off Gap as irrelevant to the younger generation. In fact, Gap’s iconic logo sweatshirts are a popular vintage item for young people taking inspiration from ‘90s fashion. Gap has also become associated with rapper Kanye West, whose streetwear brand YEEZY partnered with the fashion chain on a range of stylish apparel for men, women and children.

One brand whose meteoric rise appears to have slowed is online-only retailer Shein. The Chinese ecommerce business stormed up the fashion chart in 2021, but this quarter saw a decline in all of the metrics covered in our survey. It could be that young consumers are becoming disillusioned with Shein due to the inconsistent quality of clothing, unreliable customer service and allegations of unethical practices. 2022 will reveal whether Gen Z is ready to move on or whether there’s still room for Shein to continue its success story.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Old Navy | 96% | 37% | 30% | 42% | 100 |

| 2 | American Eagle | 91% | 31% | 27% | 41% | 88 |

| 3 | Victoria’s Secret | 93% | 30% | 26% | 37% | 78 |

| 4 | H&M | 85% | 30% | 24% | 36% | 63 |

| 5 | Forever 21 | 91% | 26% | 23% | 34% | 58 |

| 6 | Shein | 65% | 29% | 26% | 30% | 53 |

| 7 | Hollister | 85% | 20% | 18% | 28% | 43 |

| 8 | Gap | 89% | 18% | 13% | 26% | 33 |

| 9 | Urban Outfitters | 81% | 18% | 16% | 26% | 28 |

| 10 | Fashion Nova | 61% | 13% | 11% | 19% | 10 |

Fashion – Retail

We polled over 500 young people to find out which fashion – retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Since we began compiling this chart, it’s been a tale of two brands at the top: global sportswear brand Nike vs. Primark, a household name on the British high street. After tying for first place last quarter, this time Nike takes the lead, thanks to strong scores on the brand visibility and advocacy metrics.

Nike’s consistent popularity with Gen Z reflects the brand’s ability to balance cool with mainstream. While they are known for their limited edition releases that sell out in minutes and collaborations with the coolest celebrities, influencers and creatives, you can also pick up a pair of Nike trainers on any high street at a price that’s in reach for most consumers. Not everyone can afford (or wants to invest in) the latest hyped up sneaker drops, but they can still be part of the Nike community, displaying the famous swoosh symbol on their shoes or clothes as a statement of belonging.

Elsewhere in the top 10, we see positive movement for JD Sports, move from joint 4th to 3rd, overtaking Adidas and H&M. The sportswear chain had great news to share this quarter as they reported strong Black Friday sales figures, and announced they were projected to beat profit forecasts for the financial year. Another brand that’s had a boost in our chart since last quarter is Next, which grew 8% in brand engagement. This also reflects a strong Christmas season, as the retailer is a popular choice for gifts and cosy winter clothing. They have also adapted well to the ecommerce era, boosting their online offering by stocking a range of other brands in addition to Next products.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Nike | 96% | 45% | 38% | 55% | 95 |

| 2 | Primark | 94% | 53% | 50% | 52% | 93 |

| 3 | JD Sports | 94% | 41% | 33% | 46% | 75 |

| 4 | Adidas | 96% | 38% | 29% | 48% | 73 |

| 5 | H&M | 91% | 39% | 33% | 42% | 60 |

| 6 | Sports Direct | 93% | 38% | 28% | 36% | 53 |

| 7 | New Look | 90% | 33% | 24% | 34% | 38 |

| 8 | Next | 92% | 31% | 22% | 32% | 33 |

| 9 | Zara | 79% | 26% | 23% | 31% | 20 |

| 10 | Footlocker | 82% | 20% | 17% | 26% | 13 |

Sports & Athleisure

We polled over 1,000 young people to find out which sports & athleisure brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

It’s another quarter at the top for Nike in our sports and athleisure chart. The brand’s consistent popularity with Gen Z reflects its ability to balance cool with mainstream. While they are known for their limited edition releases that sell out in minutes and collaborations with the coolest celebrities, influencers and creatives, you can also pick up a pair of Nike sneakers in any mall at a price that’s in reach for most consumers. Not everyone can afford (or wants to invest in) the latest hyped up sneaker drops, but they can still be part of the Nike community, displaying the famous swoosh symbol on their shoes or clothes as a statement of belonging.

Elsewhere, it’s good news for Under Armour, which rises from fifth to fourth place, as all metrics have increased compared to our last survey in Q4. The youth demographic is of high importance to Under Armour, and the company demonstrated this with the recent announcement that it would commit to “creating opportunities for millions of youth to engage in sport by 2030.” Regarding this pledge, CEO Patrik Frisk explained: “We believe it is important to our brand, of course, but it’s incredibly important to society as well.”

Another brand that will be happy with our latest results is Puma, which moves from eighth to seventh place thanks to an increase in brand engagement, purchase intent and brand advocacy. Gen Z’s growing interest in the sportswear brand reflects an overall resurgence for the business, which recently reported a 32% increase in sales year-on-year – reported to be the strongest results in the brand’s history. Competitors will be watching Puma closely to see how they build on this impressive success in 2022.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Nike | 98% | 60% | 54% | 71% | 100 |

| 2 | Adidas | 97% | 42% | 35% | 56% | 90 |

| 3 | Vans | 94% | 37% | 29% | 50% | 80 |

| 4 | Under Armour | 93% | 29% | 23% | 44% | 70 |

| 5 | Converse | 91% | 27% | 22% | 43% | 58 |

| 6 | The North Face | 83% | 23% | 20% | 41% | 45 |

| 7 | Puma | 92% | 17% | 14% | 28% | 40 |

| 8 | Footlocker | 88% | 19% | 16% | 26% | 38 |

| 9 | Gymshark | 43% | 9% | 9% | 15% | 18 |

| 10 | Fabletics | 48% | 9% | 6% | 13% | 13 |

Fashion – Ecommerce

We polled over 500 young people to find out which online fashion brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

ASOS retains the no.1 spot in our ecommerce chart, coming out on top after a tough quarter filled with supply chain struggles. Among Gen Z at least, the brand is as strong as ever, staying consistent with 47% of 16-24s keen to recommend it to a friend. ASOS saw 2% growth in brand visibility and an impressive 4% uplift in engagement, driven by Black Friday and Christmas shopping season. The online retailer is one of Gen Z’s go-to sites for gifts and partywear over the festive period.

In second place this time is Boohoo, which has regained the runner-up position after sharing it with fast-growing rival Shein in Q4. This will be a relief for the British brand, whose position as the go-to for affordable fashion for bargain-hunting Gen Z is at risk of being usurped by their Chinese competitor. Boohoo will also have high hopes for Q1 as they enter a new market, releasing their first range of beauty products. The launch could help improve Boohoo’s reputation around sustainability, as all 50 products in the initial collection are vegan and cruelty-free, and all packaging recyclable.

Another brand that performed well this quarter was Gymshark, which entered the top five for the first time, overtaking Depop and Pretty Little Thing. Gymshark has been one of the UK’s most exciting ecommerce success stories, valued at over $1 billion after less than a decade in business. Inspired by the popularity of its pop-up shops, the brand is set to open its first permanent retail store in London in the summer of 2022.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | ASOS | 87% | 48% | 40% | 47% | 100 |

| 2 | Boohoo / Boohoo Man | 84% | 38% | 26% | 34% | 90 |

| 3 | Shein | 73% | 34% | 25% | 28% | 75 |

| 4 | Gymshark | 78% | 23% | 20% | 28% | 65 |

| 5= | Depop | 71% | 28% | 20% | 28% | 60 |

| 5= | Pretty Little Thing | 79% | 28% | 20% | 25% | 60 |

| 7 | Missguided | 64% | 17% | 12% | 18% | 40 |

| 8 | I Saw It First | 47% | 14% | 9% | 15% | 28 |

| 9 | Nasty Gal | 48% | 13% | 8% | 12% | 23 |

| 10 | In The Style | 37% | 10% | 8% | 11% | 10 |

Retail

We polled over 1,000 young people to find out which retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s no change at the top as Amazon remains at no.1 in our multi-sector retail chart. Despite concerns about supply chain issues, Amazon continued their seemingly unstoppable rise by growing sales by 9% year-on-year in Q4 2021. The company’s quarterly report recently revealed they enjoyed their most lucrative Black Friday and Cyber Monday period ever. This success is reflected in our chart, where they not only retain their place at the top, but manage to up their scores across our brand engagement, purchase intent and brand advocacy metrics.

Another brand that has cause for celebration is Bed Bath & Beyond, which overtook TJ Maxx as a result of increased scores in brand engagement and purchase intent. This comes despite the retailer reporting $100 million in lost sales in Q4, for which industry experts have blamed the reduction in their product lines, in addition to the impact of supply chain issues. The positive trend seen in our survey suggests that Gen Z has been impressed with initiatives such as the student-focused Wild Sage sub-brand that Bed Bath and Beyond launched in 2021.

Lowe’s also had a good result this quarter, overtaking JCPenney in our chart and upping their scores on every metric we track. Many people underestimate the interest Gen Z has in home improvement, but the consistent popularity of Lowe’s and category leader Home Depot in our chart shows there’s definitely demand for these brands among the younger demographic. A survey we conducted in 2021 found that 59% of Student Beans users had undertaken at least one home improvement project in the previous year.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Amazon | 99% | 87% | 83% | 80% | 100 |

| 2 | Home Depot | 97% | 37% | 26% | 42% | 88 |

| 3 | eBay | 97% | 36% | 27% | 37% | 78 |

| 4 | Bed, Bath & Beyond | 93% | 28% | 22% | 38% | 56 |

| 5 | TJ Maxx | 91% | 29% | 26% | 38% | 55 |

| 6 | Macy’s | 94% | 30% | 21% | 32% | 50 |

| 7 | Kohls | 93% | 28% | 22% | 35% | 44 |

| 8 | Lowe’s | 94% | 25% | 19% | 34% | 38 |

| 9 | JCPenney | 94% | 24% | 16% | 13% | 33 |

| 10 | Nordstrom | 78% | 14% | 10% | 25% | 10 |

Retail

We polled over 500 young people to find out which retail brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Despite concerns about supply chain issues, Amazon continued their seemingly unstoppable rise by growing sales by 9% year-on-year in Q4 2021. The company’s quarterly report recently revealed they enjoyed their most lucrative Black Friday and Cyber Monday period ever. This success is reflected in our multi-sector retail chart, where they not only retain their place at the top, but manage to up their scores across our brand engagement, purchase intent and brand advocacy metrics.

Another brand who performed well in this quarter’s survey was B&M, the bargain retailer beloved by students and young shoppers on a budget. B&M saw an increase across all metrics this quarter and moved from joint fourth to sole fourth place, overtaking Swedish furniture favourite IKEA. We saw similar success for TK Maxx, which jumped from ninth to six place, increasing its scores across the board. The business achieved a particularly strong boost in brand advocacy (i.e. would 16-24s recommend the brand to a friend), which rose from 34% to 42%.

The growing popularity of B&M and TK Maxx, both known for their value for money product ranges, demonstrate the importance of competitive pricing when marketing to Gen Z. They are a generation of savvy shoppers who won’t hesitate to pull out their phone in a store and check if they can get a better deal elsewhere. That’s why we encourage brands to offer exclusive deals for students, ensuring that young consumers know your brand values their custom and wants to support them as they enter adulthood, making purchases in new categories for the first time.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Position | Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score |

|---|---|---|---|---|---|---|

| 1 | Amazon | 97% | 78% | 71% | 67% | 100 |

| 2 | eBay | 95% | 49% | 39% | 46% | 88 |

| 3 | Argos | 94% | 40% | 31% | 44% | 74 |

| 4 | B&M | 87% | 40% | 34% | 41% | 59 |

| 5 | IKEA | 94% | 35% | 24% | 49% | 55 |

| 6 | TK Maxx | 90% | 35% | 29% | 42% | 48 |

| 7 | M&S | 92% | 39% | 27% | 38% | 45 |

| 8 | Wilko | 86% | 34% | 29% | 38% | 33 |

| 9 | Etsy | 79% | 36% | 22% | 40% | 29 |

| 10 | WHSmith | 92% | 31% | 22% | 34% | 21 |

Grocery

We polled over 1,000 young people to find out which grocery brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

After sharing the spotlight with Target last quarter, Walmart has taken the lead once again to achieve sole first place in the grocery sector chart. One area that Walmart has done particularly well in is brand advocacy, with 2% more 16-24s keen to recommend the retailer to a friend compared to our previous survey.

Some surprising news came in January as it was revealed that Walmart has filed several trademarks related to cryptocurrency, NFTs and the metaverse, suggesting they’re considering everything from their own digital currency to virtual health and wellness classes. The brand had been mocked online when a previous attempt at creating a virtual store was shared on social media, so they’ll be taking more careful steps this time to ensure any innovations or partnerships are relevant to the business and appealing to their target market. Being proactive in exploring this space, despite it being an unusual fit for the brand compared to those in sectors such as tech and fashion, will help Walmart to stay ahead of competitors if the metaverse trend continues to grow.

Elsewhere in our top 10, we see 7-Eleven moving into the top three, sharing third place with CostCo. Brand advocacy for 7-Eleven has risen by 3% compared to Q4. Also performing well this quarter is Kroger, which joins Whole Foods Market in seventh place. All metrics have increased for Kroger, but most notably visibility, which has increased by 6%. Kroger is currently striving to improve its delivery service, working with British grocery delivery business Ocado to make the option available to more customers. According to a Student Beans user survey, 68% of US students aged 16-24 either get groceries delivered or are interested in doing so.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Walmart | 98% | 80% | 75% | 64% | 98 |

| 2 | Target | 98% | 72% | 67% | 70% | 93 |

| 3= | 7-Eleven | 94% | 36% | 30% | 34% | 73 |

| 3= | CostCo | 88% | 32% | 28% | 42% | 73 |

| 5 | Aldi | 76% | 29% | 27% | 36% | 55 |

| 6 | Trader Joe’s | 80% | 24% | 24% | 36% | 50 |

| 7= | Kroger | 77% | 24% | 23% | 27% | 40 |

| 7= | Whole Foods Market | 83% | 23% | 21% | 33% | 40 |

| 9 | Safeway | 53% | 16% | 14% | 17% | 18 |

| 10 | Publix | 52% | 14% | 14% | 19% | 13 |

Supermarkets

We polled over 500 young people to find out which supermarkets resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

The biggest names in our supermarket top ten have not only stayed in place, but increased their lead over the competition this quarter. Tesco and Asda both increased their scores across the brand engagement, purchase intent and brand advocacy metrics compared to Q4 2020. Tesco reported a boost in revenue for the festive period, achieving a 2.7% increase in sales compared to Christmas 2021. The superbrand announced it had its greatest market share in four years, providing its ability to stand up to competition from popular discount retailers.

After losing their spot in the top three to Aldi, Sainsbury’s is back up there in our latest chart. The supermarket chain recently announced it expects profits to double year-on-year, following a successful Christmas season. One reason cited by the brand was its Aldi price match campaign, which saw them directly take on the competitor in marketing materials designed to dispel the idea that Sainsbury’s is more expensive. Sainsbury’s online delivery service was also credited for the company’s success, with online sales almost twice as high as two years ago. Allowing customers to shop via app has certainly helped with Gen Z – our research has found that 41% of Student Beans users have at least one grocery delivery app on their phone.

According to analysis by Kantar, consumers have returned to their pre-pandemic supermarket shopping habits, but the industry is facing new challenges as stock shortages and increased business costs have forced retailers to increase prices. This could cause stress for young shoppers, for example those living on a student loan or entry-level salary. Ensuring items targeted to this demographic remain affordable and offering student-exclusive offers will demonstrate to them that the retailer values their custom and wants to support them through financially challenging times.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Position | Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score |

|---|---|---|---|---|---|---|

| 1 | Tesco | 96% | 73% | 69% | 65% | 100 |

| 2 | ASDA | 96% | 61% | 50% | 52% | 88 |

| 3 | Sainsbury’s | 96% | 53% | 46% | 49% | 78 |

| 4 | Aldi | 95% | 51% | 43% | 50% | 73 |

| 5 | Lidl | 95% | 44% | 42% | 49% | 63 |

| 6 | Co-op | 94% | 43% | 35% | 37% | 49 |

| 7 | Morrison’s | 94% | 38% | 33% | 35% | 41 |

| 8 | Iceland | 92% | 32% | 26% | 31% | 30 |

| 9 | Waitrose | 89% | 16% | 18% | 23% | 20 |

| 10 | Spar | 74% | 14% | 12% | 16% | 10 |

Entertainment

We polled over 1,000 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Netflix remains at the top this quarter, even managing to increase its score for the important purchase intent metric. One driver of their success in Q4 was undoubtedly the selection of original holiday movies that viewers flock to Netflix to enjoy. This has become an annual tradition in recent years, especially as the streamer has appealed to a market that’s looking for a fresh take on festive films, with more diverse and inclusive casts and storylines. Hits in 2021 included Single All The Way and The Princess Switch 3.

While Netflix is clearly still a firm favorite among Gen Z, they are facing increasingly stiff competition from other streaming platforms. For example, purchase intent also increased for Hulu and Prime Video, while Disney+ improved on its scores across engagement, intent and advocacy. However, for Gen Z this doesn’t have to be a zero sum game. In fact, 29% of the 16-24s we surveyed had engaged with all four of the video streaming platforms in our list within the previous three months.

While our top five is filled with streaming services, gaming also has a strong presence in the entertainment sector. Recently released games consoles like the Playstation 5 and Xbox Series X were top of many young people’s festive gift wishlists. The only thing holding them back is supply issues, especially due to the chip shortages that are affecting both brands. Once this problem is resolved, we’ll be keen to see how this affects engagement with these beloved Gen Z brands.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Netflix | 98% | 80% | 59% | 75% | 98 |

| 2 | YouTube | 98% | 87% | 40% | 75% | 88 |

| 3 | Spotify | 97% | 59% | 41% | 58% | 80 |

| 4 | Hulu | 96% | 59% | 43% | 55% | 65 |

| 5 | Disney+ | 96% | 58% | 39% | 57% | 58 |

| 6 | Prime Video | 96% | 56% | 39% | 47% | 48 |

| 7 | Playstation | 96% | 35% | 26% | 41% | 38 |

| 8 | Nintendo | 96% | 39% | 26% | 44% | 35 |

| 9 | Xbox | 97% | 34% | 22% | 39% | 30 |

| 10 | Apple Music | 94% | 31% | 23% | 33% | 13 |

Entertainment

We polled over 500 young people to find out which entertainment brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Netflix remains at the top this quarter, even managing to increase their scores across each of the metrics we track. One driver of their success in Q4 was undoubtedly the selection of original Christmas movies that viewers flock to Netflix to enjoy. This has become an annual tradition in recent years, especially as the streamer has appealed to a market that’s looking for a fresh take on festive films, with more diverse and inclusive casts and storylines. Hits in 2021 included Single All The Way and The Princess Switch 3.

While Netflix is clearly still a firm favourite among Gen Z, they are facing increasingly stiff competition from other streaming platforms. For example, recently published research by Kantar found that in the UK, Prime Video subscriptions are increasing, while Netflix’s growth has stalled. The challenge for a brand like Netflix that has been at the top of its industry for many years is finding ways to win over those last holdouts, but this emphasises the importance of the Gen Z market: a new generation of customers whose loyalty is still up for grabs.

While our top five is filled with streaming services, gaming also has a strong presence in the entertainment sector. Recently released games consoles like the Playstation 5 and Xbox Series X were top of many young people’s festive gift wishlists. The only thing holding them back is supply issues, especially due to the chip shortages that are affecting both brands. Once this problem is resolved, we’ll be keen to see how this affects engagement with these beloved Gen Z brands.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Netflix | 97% | 79% | 57% | 73% | 98 |

| 2 | YouTube | 97% | 80% | 36% | 65% | 88 |

| 3 | Spotify | 96% | 62% | 44% | 62% | 83 |

| 4 | Amazon Prime Video | 95% | 59% | 42% | 50% | 64 |

| 5 | Disney+ | 95% | 51% | 35% | 53% | 59 |

| 6 | Playstation | 95% | 39% | 29% | 41% | 54 |

| 7 | Xbox | 95% | 35% | 23% | 35% | 44 |

| 8 | Nintendo | 93% | 30% | 22% | 38% | 33 |

| 9 | Apple Music | 92% | 23% | 16% | 23% | 18 |

| 10 | Game | 85% | 21% | 16% | 26% | 13 |

Travel

We polled over 1,000 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

This quarter Uber remains in first place in our travel chart, but the rideshare company could be seeing the impact of driver shortages and a resulting rise in costs for consumers, as brand advocacy dipped by 3% between Q4 and Q1. High engagement and purchase intent compared to other travel brands shows Gen Z remained comfortable riding with Uber, even amid the Omicron wave, but positive sentiment toward the business is waning as customers endure frustrating experiences trying to use the service, especially at busy times such as the holiday party season.

There’s better news for Airbnb, which saw an increase in purchase intent compared to our last survey. In addition to their primary service, Airbnb has also reported a growth in interest in Airbnb Experiences among the Gen Z demographic. In a recent news post, the company reported that under-24s were the “fastest growing guest segment” for this particular product, which gives customers the chance to try out anything from sports activities to local cooking classes while on vacation.

One sub-sector of our travel chart that had a positive end to 2021 is booking sites. Both Booking.com and Expedia upped their brand engagement score compared to the previous quarter. A recent survey of Student Beans users found that 84% of students aged 16-24 plan to take a vacation during the summer break this year, and their top priority will be seeking an affordable price, so it’s no surprise that usage of comparison sites is on the up. However, 81% said friend and family recommendations would influence where they go and how they book their trip, so brand reputation will be key to winning their custom this year.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 97% | 40% | 36% | 49% | 100 |

| 2 | Lyft | 90% | 25% | 23% | 35% | 88 |

| 3 | Airbnb | 88% | 23% | 20% | 38% | 80 |

| 4 | American Airlines | 89% | 14% | 11% | 24% | 69 |

| 5 | Delta | 86% | 15% | 11% | 23% | 58 |

| 6 | Southwest Airlines | 77% | 13% | 11% | 22% | 45 |

| 7 | TripAdvisor | 80% | 13% | 9% | 22% | 33 |

| 8 | United Airlines | 85% | 12% | 10% | 20% | 30 |

| 9 | Booking.com | 62% | 13% | 11% | 18% | 29 |

| 10 | Expedia | 73% | 13% | 9% | 20% | 20 |

Travel

We polled over 500 young people to find out which travel brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

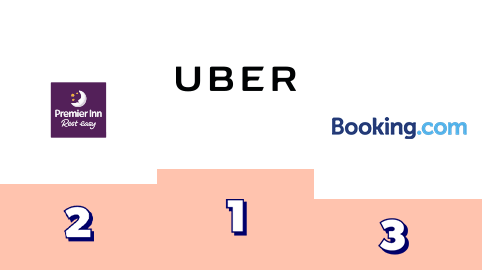

Key Takeaways:

This quarter Uber remains in first place in our travel chart, but the rideshare company could be seeing the impact of driver shortages and a resulting rise in costs for consumers, as brand advocacy dipped by 5% between Q4 and Q1. High engagement and purchase intent shows Gen Z remained comfortable riding with Uber, even amid the Omicron wave, but positive sentiment toward the business is waning as customers endure frustrating experiences trying to use the service, especially at busy times such as the Christmas party season. These issues could open up the rideshare market to other apps, such as fast-growing European competitor Bolt, which was recently valued at €7.4 billion.

There was more disruption in the middle of our travel top ten, as we saw Booking.com enter the top three, replacing British Airways, which slipped down to sixth place. We also saw EasyJet take a tumble from sixth to ninth, suggesting that air travel was not top of mind for Gen Z at the time of our survey. While most travel routes have remained open, the surge in COVID-19 cases due to Omicron has been a cause for concern for many consumers, especially those less experienced travellers who don’t want to deal with the stress of seeking refunds or rearranging their trip.

There’s better news for Airbnb, which moved from fifth to fourth place and saw an increase across all metrics. In addition to their primary service, Airbnb has also reported a growth in interest in Airbnb Experiences among the Gen Z demographic. In a recent news post, the company reported that under-24s were the “fastest growing guest segment” for this particular product, which gives customers the chance to try out anything from sports activities to local cooking classes while on holiday.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Uber | 93% | 41% | 43% | 43% | 100 |

| 2 | Premier Inn | 91% | 29% | 26% | 39% | 83 |

| 3 | Booking.com | 81% | 28% | 24% | 34% | 65 |

| 4 | Airbnb | 85% | 24% | 23% | 33% | 55 |

| 5 | Travelodge | 87% | 22% | 17% | 27% | 54 |

| 6 | British Airways | 91% | 21% | 18% | 32% | 48 |

| 7 | National Express | 80% | 20% | 20% | 26% | 45 |

| 8 | RyanAir | 85% | 16% | 17% | 24% | 36 |

| 9 | Easy Jet | 89% | 19% | 16% | 30% | 35 |

| 10 | TUI | 73% | 13% | 12% | 22% | 30 |

Health & Beauty

We polled over 1,000 young people to find out which health & beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

After switching places with CVS last quarter, Walgreens is back at the top this time around in our health and beauty chart, thanks to a rise in purchase intent giving the pharmacy chain the edge over its close competitor. Both brands have stepped up to play an important role during the pandemic, and recently this took on a new element as demand grew dramatically for COVID-19 rapid tests amid the rise of the Omicron variant. The businesses were forced to place limits on how many rapid tests customers could order, but the limits were recently lifted as stock levels improved. Pharmacies will also be giving out free face masks thanks to a new government initiative, which will help to drive more footfall in stores, as well as keeping customers safe.

Many of the brands in this category overindex with female 16-24 customers compared to males. For example 56% of females have engaged with Bath & Body Works in the last three months, much higher than the brand’s overall engagement score of 44%, and indeed higher than any of the other brands’ engagement scores. So what is it about Bath & Body Works that really resonates with the Gen Z female? The company’s brand personas is stylish yet accessible, and their products are a little pricier than you might spend on the same items in the average drugstore, but not out of reach for a younger shopper.

It’s clearly not just Gen Z who are on board with Bath & Body Works, as the company reported record Q4 sales and earning in 2021. CEO Andrew Meslow said the success was “driven by our focus on staying close to our customers and our commitment to operational excellence.”

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Position | Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score |

|---|---|---|---|---|---|---|

| 1 | Walgreens | 95% | 52% | 47% | 50% | 98 |

| 2= | Bath & Body Works | 94% | 44% | 37% | 52% | 86 |

| 2= | CVS | 94% | 51% | 45% | 49% | 86 |

| 4 | Ulta Beauty | 77% | 29% | 27% | 41% | 65 |

| 5 | Seophora | 81% | 24% | 21% | 37% | 63 |

| 6 | e.l.f Cosmetics | 56% | 20% | 18% | 28% | 40 |

| 7= | L’Oreal | 81% | 18% | 15% | 25% | 35 |

| 7= | Maybelline | 74% | 17% | 16% | 26% | 35 |

| 9 | Rite Aid Corporation | 66% | 19% | 16% | 20% | 30 |

| 10 | MAC | 59% | 10% | 9% | 19% | 13 |

Health & Beauty

We polled over 500 young people to find out which health & beauty brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Boots remains in first place in our health and beauty top ten, but experiences a decline in two important metrics: brand engagement and purchase intent. This could be down to young consumers designating more of their budget to non-essential items over the festive period, or it could be attributed to a number of recent negative news stories related to the brand, such as reduced opening hours affecting staff salaries and the controversial inclusion of the morning after pill in their Black Friday sale. This angered those who had been campaigning for the pill to be made more affordable year-round. However, the retailer has since announced that they have cut the price to £10, in response to accusations that they were imposing a “sexist surcharge.”

Elsewhere in our chart, MyProtein jumps from ninth to eighth place, potentially benefitting from the “new year new me” trend which sees a major focus on fitness at the start of a new year. Google Trends shows searches for “protein” grew 132% between the week of Christmas and the first week of January. MyProtein saw a particular growth in visibility from 43% to 48%. This is great news for one of the newest brands in our top ten (only Pure Gym was founded more recently), as it shows their marketing efforts are resonating with the Gen Z demographic.

One brand not faring so well this time around is Beauty Bay, which saw a drop of 4% in purchase intent and 3% in brand advocacy. The online beauty retailer will be looking to Valentine’s Day to boost sales in Q1, for example with the launch of the Love Notes Palette. The business is also broadening its target market by embracing customers of all genders, which is reflected in their diverse advertising images.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Boots | 93% | 56% | 50% | 55% | 100 |

| 2 | Superdrug | 90% | 48% | 42% | 48% | 90 |

| 3= | Gillette | 86% | 28% | 25% | 32% | 70 |

| 3= | The Body Shop | 81% | 30% | 21% | 35% | 70 |

| 5 | Holland & Barrett | 81% | 27% | 23% | 32% | 63 |

| 6 | Lush | 74% | 24% | 19% | 35% | 55 |

| 7 | Pure Gym | 77% | 20% | 17% | 23% | 43 |

| 8 | MyProtein | 48% | 17% | 15% | 19% | 25 |

| 9= | Beauty Bay | 42% | 15% | 12% | 21% | 18 |

| 9= | MAC | 66% | 16% | 9% | 19% | 18 |

Restaurants & Takeout

We polled over 500 young people to find out which restaurants and takeout brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s change at the top of our restaurants and takeout chart as Starbucks overtakes McDonald’s for the first time. Q4 is always a great time of year for Starbucks as its most iconic products are in season, including the pumpkin spice latte and the red cups that come out for the winter holidays. When consumers are looking for a cosy experience, Starbucks is perfectly positioned to step in, and their branding excels at this time of year.

Overall, purchase intent and brand advocacy have increased across this sector. In the colder months, heading out to a restaurant or ordering takeout for a night in with friends or family is a great entertainment option. This also shows a growing confidence in dining out following the omicron surge which saw COVID-19 case numbers reach new peaks at the beginning of 2022.

Two brands that have seen a noticeable improvement in their scores since last quarter are two of the burger chains that appear in our chart: Wendy’s and Burger King. Wendy’s climbed from sixth to fourth position with an impressive 5% increase in brand advocacy compared to Q4. Similarly, Burger King jumped from no.10 to no.8, thanks to a rise in advocacy as well as brand engagement and purchase intent. Young people may be associated with healthy eating and trends such as veganism, but this doesn’t mean there isn’t still a huge audience for fast food among Gen Z. They’re willing to try new cuisines, but classic meals such as a burger and fries will always be a winner with young consumers.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Starbucks | 98% | 57% | 55% | 59% | 95 |

| 2 | McDonald’s | 98% | 71% | 63% | 52% | 93 |

| 3 | Chick-Fil-A | 97% | 52% | 50% | 57% | 68 |

| 4 | Wendy’s | 98% | 46% | 42% | 48% | 64 |

| 5 | Taco Bell | 98% | 52% | 45% | 46% | 58 |

| 6 | Subway | 98% | 45% | 44% | 48% | 55 |

| 7 | Dunkin’ Donuts | 97% | 40% | 38% | 47% | 41 |

| 8 | Burger King | 98% | 38% | 33% | 34% | 34 |

| 9 | Chipotle | 96% | 36% | 38% | 47% | 26 |

| 10 | Pizza Hut | 97% | 32% | 30% | 40% | 18 |

Restaurants & Takeaway

We polled over 500 young people to find out which restaurants and takeaway brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

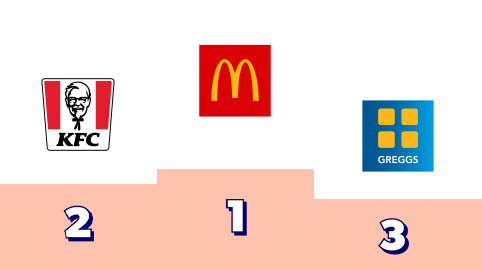

Key Takeaways:

This quarter McDonald’s retains the top spot in our restaurant and takeaway chart, but they’ll need to brainstorm some strong strategies to engage Gen Z in 2022 as they saw a decline across each of the metrics we track. The biggest drop was in engagement, down to 70% from 76% the previous quarter. This could reflect young people spending less on fast food as they invested in gifts and treats for the festive season, but it is surprising considering the major advertising campaign the burger chain ran for its Christmas menu, including a festive crispy chicken burger, Celebrations McFlurry and camembert bites.

One brand who clearly had a very merry Christmas is Domino’s, which jumped from fifth to fourth place in our top ten, overtaking Subway. As a business reliant on customers eating at home, it may have benefited from the colder weather, as well as young people ordering pizza to help them get over their hangovers amid the December party season.

Also faring well this quarter is Costa Coffee, which has caught up with its competitor Starbucks and joined them in equal sixth place. This was thanks to an increase in engagement, purchase intent and brand advocacy. Slightly lower down the chart, Nando’s also made gains on the same three metrics, bouncing back after a tough Q3 where restaurants in the chain were forced to close due to supply shortages that meant they didn’t have enough chicken to cater to demand, while the “pingdemic” made things even harder for the business as staff were forced to isolate.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | McDonald’s | 96% | 70% | 64% | 58% | 98 |

| 2 | KFC | 97% | 49% | 41% | 51% | 80 |

| 3 | Greggs | 95% | 52% | 48% | 53% | 78 |

| 4 | Domino’s | 96% | 45% | 38% | 46% | 56 |

| 5 | Subway | 96% | 43% | 42% | 46% | 55 |

| 6= | Costa Coffee | 94% | 45% | 43% | 44% | 53 |

| 6= | Starbucks | 96% | 38% | 39% | 45% | 53 |

| 8 | Nando’s | 94% | 35% | 35% | 50% | 38 |

| 9 | Pizza Hut | 96% | 29% | 23% | 40% | 29 |

| 10 | Krispy Kreme | 87% | 26% | 22% | 43% | 11 |

Tech & Mobile

We polled over 1,000 young people to find out which tech & mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

There’s disruption at the top of our tech and mobile chart this quarter as Google steps up to join Apple in equal first place. This comes as Apple takes a dip across all four of the metrics we track, while Google increases their score for purchase intent, showing that more US 16-24s plan to shop from the brand in Q1 than Q4. This is an impressive achievement for any brand in the tech category, as Black Friday (taking place in Q4) is such a big sales driver for these products.

Google is flying high at the moment after reporting record profits in Q4 2021, defying expectations that the tech industry couldn’t keep up the growth it achieved during the COVID-19 lockdowns when consumers relied on tech more than ever. In addition to its ever-presence in Gen Z’s online lives, the younger generation also have a positive view of the company as a trusted brand for devices such as smartphones and laptops. The affordable Chromebook is an entry-level laptop for many young people getting a computer of their own for the first time.

Another brand entering 2022 on a positive note is T-Mobile, which caught up with its competitor AT&T, now sharing seventh place. This was thanks to an increase of 5% in purchase intent and 6% in brand advocacy, showing that a growing number of 16-24s plan to spend money on T-Mobile and would be happy to recommend the company to a friend. The business’ CEO recently described 2021 as their “strongest year ever,” with achievements including rolling out their 5G coverage to reach 210 million Americans – putting them far ahead of AT&T and Verizon.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1= | Apple | 98% | 64% | 44% | 64% | 95 |

| 1= | 98% | 73% | 34% | 61% | 95 | |

| 3 | Best Buy | 97% | 36% | 29% | 46% | 71 |

| 4 | Microsoft | 97% | 43% | 24% | 44% | 69 |

| 5 | Verizon | 97% | 30% | 18% | 35% | 55 |

| 6 | Samsung | 97% | 29% | 16% | 36% | 53 |

| 7= | AT&T | 97% | 27% | 19% | 27% | 38 |

| 7= | T-mobile | 96% | 27% | 20% | 29% | 38 |

| 9 | Sony | 96% | 24% | 16% | 30% | 28 |

| 10 | Xfinity | 82% | 20% | 12% | 20% | 10 |

Tech & Mobile

We polled over 500 young people to find out which tech & mobile brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

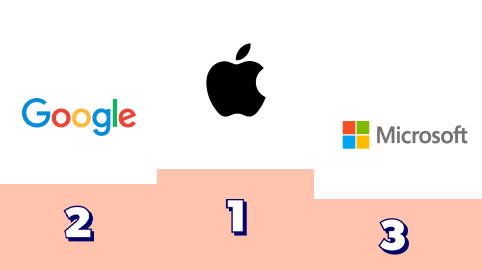

Key Takeaways:

Apple stays at the top this quarter thanks to its strong brand recognition and customer loyalty, but it has taken a dip across several of the metrics we track: brand engagement, purchase intent and brand advocacy. This creates an opening for a competitor such as Google, which improved on their previous scores for engagement and intent, to take the lead. Google is flying high at the moment after reporting record profits in Q4 2021, defying expectations that the tech industry couldn’t keep up the growth it achieved during the COVID-19 lockdowns when consumers relied on tech more than ever.

As for the homegrown brands in our list, it’s been a great quarter for Currys PC World, which saw an increase in brand engagement, purchase intent and brand advocacy and moved from fifth to sixth position, overtaking Sky. This was no doubt driven by the Black Friday sales, which are pivotal to the success of multi-brand tech retailers like Currys. A recent survey of Student Beans users found that 60% of them spent money on Black Friday or Cyber Week deals in 2021, and tech and mobile was one of the top sectors they were looking for deals on, along with fashion and beauty.

Another brand on the up was O2, which moved from tenth to eighth place, overtaking their direct competitor Vodafone, as well as Sony. While Vodafone has slightly higher recognition among Gen Z, perhaps thanks to their youth-focused brand VOXI, O2 has the edge on the other three metrics, showing that in practice more 16-24s are using their service and willing to recommend it to a friend.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Apple | 98% | 55% | 36% | 55% | 98 |

| 2 | 97% | 63% | 29% | 53% | 93 | |

| 3 | Microsoft | 96% | 47% | 20% | 44% | 75 |

| 4 | Samsung | 96% | 34% | 21% | 42% | 70 |

| 5 | Currys PC World | 94% | 31% | 23% | 38% | 58 |

| 6 | Sky | 94% | 32% | 17% | 30% | 55 |

| 7 | EE | 91% | 26% | 16% | 27% | 31 |

| 8 | O2 | 93% | 26% | 16% | 26% | 26 |

| 9= | Sony | 93% | 22% | 14% | 27% | 23 |

| 9= | Vodafone | 94% | 24% | 14% | 23% | 23 |

Food & Drink

We polled over 1,000 young people to find out which food & drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

Food and drink is one of the sectors where we see the most movement in our chart each quarter, and this time is no different. Doritos has overtaken Oreo to return to the no.1 spot, which can be accredited to an increase of 7% in brand engagement, 8% in purchase intent and 3% in brand advocacy. This puts Doritos above the competition on every metric except for visibility, where it’s tied with Coca Cola, Oreo, Hershey’s and Pepsi.

Doritos is one of the brands that will be looking forward to a boost in sales in Q1 following the Super Bowl, where they will be premiering a new commercial. This year’s Doritos Super Bowl commercial features rapper Megan the Stallion and sinegr Charlie Puth. Megan also features in video and social media ads as part of the campaign, which promotes Doritos and Flamin’ Hot Cheetos, and released a cover of the ‘90s classic Push It by Salt ‘n’ Pepa, adding a reference to “a bag of flamin’ hot chips.” As one of Gen Z’s favorite music stars, recruiting Megan for the partnership was a great move for Doritos.

Another brand on the up is Hershey’s, which rose from fifth to fourth place this quarter, overtaking M&Ms. Hershey’s’ growth across all four of our metrics can be linked to the festive period, when each year they release many seasonal products that are popular gifts and treats. In addition to the usual favorites, Hershey’s’ new releases for the holidays in 2021 include special edition Hershey’s Kisses in partnership with The Grinch, a new chocolate reindeer and a sugar cookie-flavored candy bar.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Doritos | 98% | 66% | 61% | 66% | 89 |

| 2 | Coca Cola | 98% | 64% | 57% | 59% | 84 |

| 3 | Oreo | 98% | 59% | 53% | 66% | 79 |

| 4 | Hershey’s | 98% | 58% | 50% | 61% | 69 |

| 5 | Lay’s | 95% | 58% | 54% | 59% | 55 |

| 6 | M&M’s | 97% | 53% | 47% | 59% | 49 |

| 7 | Pepsi | 98% | 53% | 46% | 48% | 45 |

| 8 | Reese’s | 97% | 54% | 44% | 57% | 40 |

| 9 | Ben & Jerry’s | 86% | 29% | 34% | 54% | 18 |

| 10 | Nestlé | 93% | 35% | 32% | 46% | 15 |

Food & Drink

We polled over 500 young people to find out which food & drink brands resonate most with them. Here you’ll find the results of our quarterly survey and our analysis of the latest trends in this sector. Get started by filtering the graphs by the metrics you’re most interested in.

Key Takeaways:

It’s been a tale of two brands in our food and drink sector chart over the past year, and yet again we see a change at the top as Cadbury’s overtakes Coca Cola, swapping places from last quarter. For Cadbury’s, brand engagement and advocacy have increased since we last ran our survey in Q4. This could be the result of the festive season, with chocolate being a popular gift and treat, playing a role in Christmas traditions from advent calendars to tree decorations. Looking ahead to later in Q1, Cadbury’s marketing efforts will turn to Easter, with products such as Mini Eggs and Creme Eggs returning to the shelves.

Another brand that had a good Q4 was Pepsi, which overtook Oreo to reach third place this time around. This is their highest position since Q1 2021, the last time Pepsi was in the top three. Pepsi is currently gearing up for its biggest branding moment of the year in February, as sponsor of the Super Bowl Half Time Show. While the game itself isn’t a big deal in the UK, the Half Time Show is always a hot topic with music fans flocking to catch up online the next day. Pepsi’s trailer for the show, this year featuring an array of rap and R&B stars, has amassed over 12 million views on YouTube alone.

A homegrown British brand that’s enjoying a promising start to 2022 is Galaxy, which moves from ninth to sixth place, improving on their performance last quarter across all metrics. Galaxy recently jumped on the blonde chocolate trend, launching a sea salt and blonde chocolate bar. Viewed as a more premium flavour than the usual milk, white or dark, Galaxy’s choice to release a blonde chocolate bar shows its commitment to positioning itself as more of an upmarket treat than the other corner shop classics, while giving consumers the chance to try out the trend for an affordable price.

Leaderboard:

The top 3 brands that are winning with Gen Z in this sector, based on our Youth Affinity Score.

Full Results:

| Brand Name | Brand visibility | Brand engagement | Purchase intent | Brand advocacy | Youth affinity score | |

|---|---|---|---|---|---|---|

| 1 | Cadbury’s | 94% | 65% | 59% | 62% | 90 |

| 2 | Coca Cola | 98% | 64% | 56% | 54% | 85 |

| 3 | Pepsi | 97% | 54% | 47% | 53% | 68 |

| 4= | Oreo | 95% | 49% | 46% | 54% | 65 |

| 4= | Walkers | 94% | 57% | 53% | 54% | 65 |

| 6 | Galaxy | 95% | 50% | 42% | 54% | 63 |

| 7 | Ben & Jerry’s | 93% | 41% | 43% | 59% | 49 |

| 8= | Heinz | 92% | 48% | 42% | 46% | 25 |

| 8= | Maltesers | 93% | 48% | 39% | 52% | 25 |

| 10 | Red Bull | 93% | 33% | 29% | 35% | 16 |

Unlock the latest results

Complete your details to reveal the standings this quarter, access exclusive sector insights and see which brands are winning with Gen Z right now.

Quarterly Commentary

Q1 2022

Welcome back to the quarterly Youth Brand Affinity Index from Student Beans, celebrating the brands that are resonating best and driving the most revenue from the 16-24 demographic across the US. In the following chapters you’ll learn which brands are on the rise with the valuable youth consumer and which are struggling, and we’ll share our analysis and predictions for the quarter ahead.

In this edition of the report, we’re looking back at which brands were the winners and losers of the 2021 festive season, along with shopping events such as Black Friday and Cyber Monday. After a tough 2020, the pressure was on to achieve record profits as the economy bounced back, but retailers were hit with a new challenge as they contended with supply chain issues and staff shortages that put their goals at risk. From fashion to food, tech to travel, we’ll reveal how Gen Z’s favorite brands fared.

In addition to looking back at the retail climax of 2021, we’ll also be looking ahead to see which brands could be the stars of 2022. The new year always brings a renewed focus on sectors such as health and travel as consumers think about their goals and dreams for the year ahead. Our research shows which brands 16-24s were planning to spend money on over the next three months, as of the start of Q1. It also reveals which brands they’re most likely to recommend to their friends, showing which marketing strategies have really done their magic with Gen Z, and which brands might need to up their game in 2022.

Methodology

Youth Affinity data is gathered every quarter, using the independent research panel provider Prodege to reach a nationally representative panel of over 1,000 young people aged 16-24, in line with US census data. The Q1 survey took place in January 2022.

For each sector, we provided respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

These four metrics were combined to calculate a Youth Affinity Score for each brand, which we have used to create a ranking of the top 10 in each sector.

Quarterly Commentary

Q1 2022 UK

Welcome back to the quarterly Youth Brand Affinity Index from Student Beans, celebrating the brands that are resonating best and driving the most revenue from the 16-24 demographic across the UK. In the following chapters you’ll learn which brands are on the rise with the valuable youth consumer and which are struggling, and we’ll share our analysis and predictions for the quarter ahead.

In this edition of the report, we’re looking back at which brands were the winners and losers of the 2021 festive season, along with shopping events such as Black Friday and Cyber Monday. After a tough 2020, the pressure was on to achieve record profits as the economy bounced back, but retailers were hit with a new challenge as they contended with supply chain issues and staff shortages that put their goals at risk. From fashion to food, tech to travel, we’ll reveal how Gen Z’s favourite brands fared.

In addition to looking back at the retail climax of 2021, we’ll also be looking ahead to see which brands could be the stars of 2022. The new year always bring a renewed focus on sectors such as health and travel as consumers think about their goals and dreams for the year ahead. Our research shows which brands 16-24s were planning to spend money on over the next three months, as of the start of Q1. It also reveals which brands they’re most likely to recommend to their friends, showing whose marketing strategies have really done their magic with Gen Z, and which brands might need to up their game in 2022.

Methodology

Youth Affinity data is gathered every quarter, using the independent research panel provider Prodege to reach a nationally representative panel of over 500 young people aged 16-24, in line with UK census data. The Q1 survey took place in January 2022.

For each sector, we provided respondents with a list of 10 leading brands. For each brand, they were asked:

- Brand visibility: which brand names they were most aware of

- Brand engagement: whether they had engaged with them in the past three months

- Purchase intent: whether they expected to buy from them in the next three months

- Brand advocacy: whether they would recommend them to a friend

These four metrics were combined to calculate a Youth Affinity Score for each brand, which we have used to create a ranking of the top 10 in each sector.