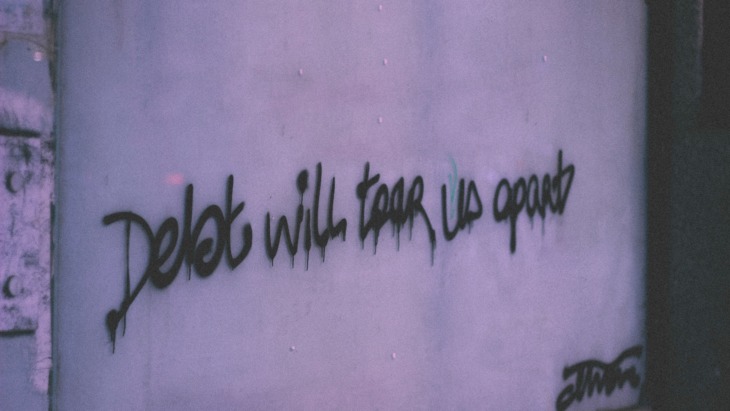

By the time US college students graduate, they’re likely to have accrued almost a lifetime of debt. The key question is – how did this happen? And how can student-facing brands and institutions soften this dire financial situation? Here, we work through some of the key questions about the student loan crisis plaguing colleges across the country.

What is the US student debt crisis?

Today, US college students grapple with two opposing beasts. The first is the growing importance of a college degree in earning a living wage. And the second? The ever-rising cost of a college education. Since the 1980s, the pot of state college aid has shrunk to virtually nothing – leaving many aspiring college students in an impossible position. To earn a college degree – and as a result, increase their chances of earning a living wage – they have to take on huge quantities of personal debt.

The US student debt crisis in numbers

According to NBC, 44 million students and graduates hold some form of student debt. The total amount of student debt owed is in the regions of $1.6 trillion. On average, that works out to about $29,000 per person.

Why did this happen – and what can be done to fix it?

Whereas historically, graduates paid back their student debt in the form of higher tax revenue, the picture today is very different. Students take on their debt on a personal level, and accrue steep interest rates on an already-hefty loan. It’s a grim picture for many – one that pushes major life events, such as marriage, children and home ownership – even further into the future.

With so many factors at play within the student debt crisis – universities, lenders, and the students themselves – there really is no quick fix. Some commentators have proposed a taxpayer bailout, in which the $1.6 trillion figure would be transferred onto US taxpayers to alleviate the burden on individuals. Other proposed solutions include allowing graduates’ employers to partially contribute to student loan repayments, or making college education less expensive in the first place.

Where does this leave current college students?

For aspiring students, the student debt crisis can be a huge burden. If students do decide to attend college and take on debt, they might choose to remain in state rather than opting for a more expensive out-of-state option. Regardless of how students get there, anyone who is self-funding their degree is guaranteed to have made some sacrifices along the way.

For brands and institutions with a student focus, the student debt crisis is crucial to understand. It goes a long way to explaining why Gen Z are prone to anxiety and stress – and also why this cohort are so sensible with money. Until something changes, they’ll likely be grappling with the reality of student debt for some time. Whatever brands can do to offer lucrative discounts and money-saving options will be welcomed.

Our latest Student Shopping Report has landed. Find out how the 37 million US college students approach key spending decisions – and what you can do to win their custom.